Hasbro 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

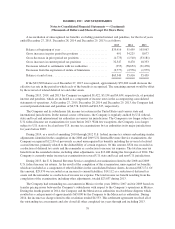

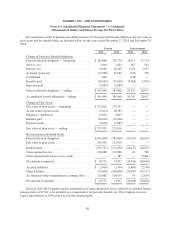

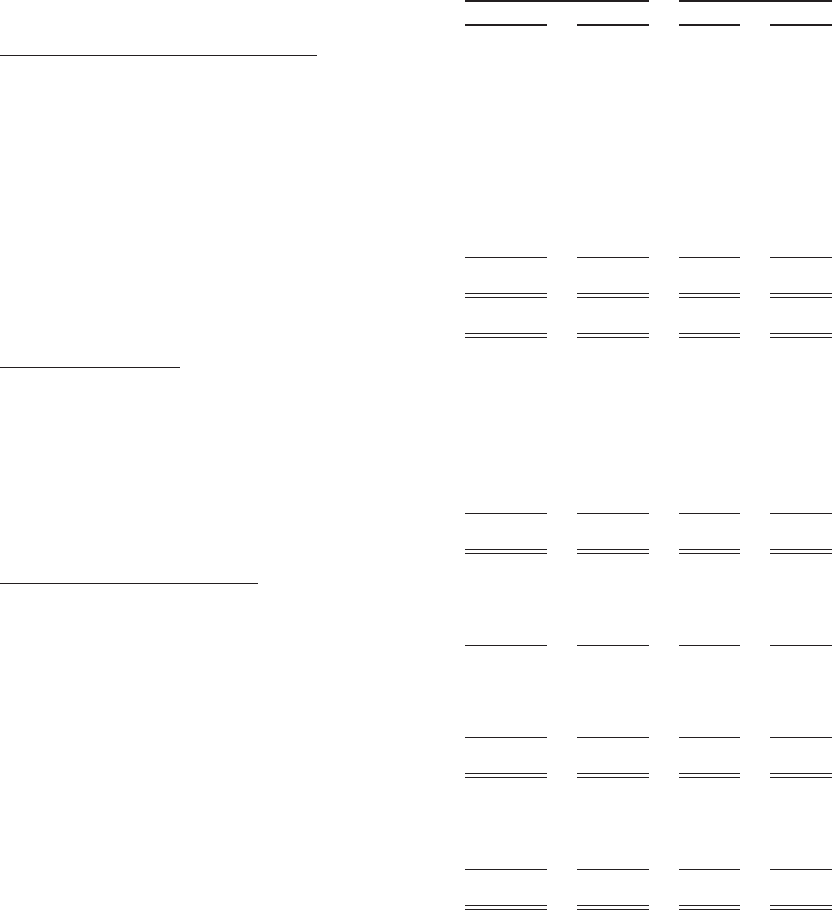

Reconciliations of the beginning and ending balances for the projected benefit obligation, the fair value of

plan assets and the funded status are included below for the years ended December 27, 2015 and December 28,

2014.

Pension Postretirement

2015 2014 2015 2014

Change in Projected Benefit Obligation

Projected benefit obligation — beginning .......... $383,068 332,774 28,017 27,174

Service cost ................................. 1,918 1,824 567 543

Interest cost ................................. 15,683 16,209 1,154 1,337

Actuarial (gain) loss ........................... (17,968) 59,640 (741) 796

Curtailment ................................. 660 — (746) —

Benefits paid ................................ (20,202) (25,690) (2,004) (1,833)

Expenses paid ................................ (2,099) (1,689) — —

Projected benefit obligation — ending ............ $361,060 383,068 26,247 28,017

Accumulated benefit obligation — ending ......... $361,060 383,068 26,247 28,017

Change in Plan Assets

Fair value of plan assets — beginning ............. $272,010 273,337 — —

Actual return on plan assets ..................... (3,414) 20,385 — —

Employer contribution ......................... 13,034 5,667 — —

Benefits paid ................................ (20,202) (25,690) — —

Expenses paid ................................ (2,099) (1,689) — —

Fair value of plan assets — ending ............... $259,329 272,010 — —

Reconciliation of Funded Status

Projected benefit obligation ..................... $(361,060) (383,068) (26,247) (28,017)

Fair value of plan assets ........................ 259,329 272,010 — —

Funded status ................................ (101,731) (111,058) (26,247) (28,017)

Unrecognized net loss ......................... 120,482 123,968 41 782

Unrecognized prior service cost (credit) ........... — 187 — (3,401)

Net amount recognized ........................ $ 18,751 13,097 (26,206) (30,636)

Accrued liabilities ............................ $ (2,663) (2,990) (1,800) (2,100)

Other liabilities .............................. (99,068) (108,068) (24,447) (25,917)

Accumulated other comprehensive earnings (loss) . . . 120,482 124,155 41 (2,619)

Net amount recognized ........................ $ 18,751 13,097 (26,206) (30,636)

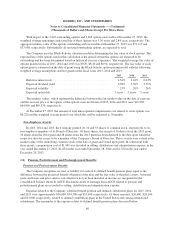

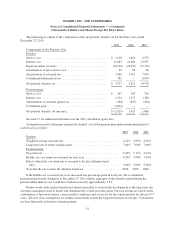

In fiscal 2016, the Company expects amortization of unrecognized net losses related to its defined benefit

pension plans of $7,361 to be included as a component of net periodic benefit cost. The Company does not

expect amortization in 2016 related to its postretirement plan.

88