Hasbro 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

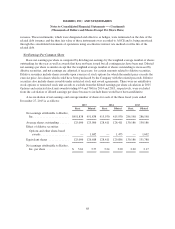

deferred losses, net of tax, of $19,363 related to these instruments remained in AOCE. For the years ended

December 27, 2015 and December 28, 2014, losses, net of tax of $1,148 and $1,156, respectively, were

reclassified from AOCE to net earnings.

Of the net deferred gains included in AOCE at December 27, 2015, the Company expects approximately

$63,181 to be reclassified to the consolidated statements of operations within the next 12 months. However, the

amount ultimately realized in earnings is dependent on the fair value of the hedging instruments on the settlement

dates.

See notes 14 and 16 for additional discussion on reclassifications from AOCE to earnings.

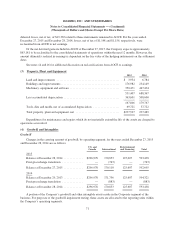

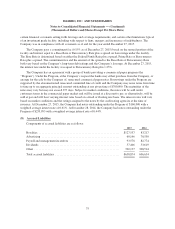

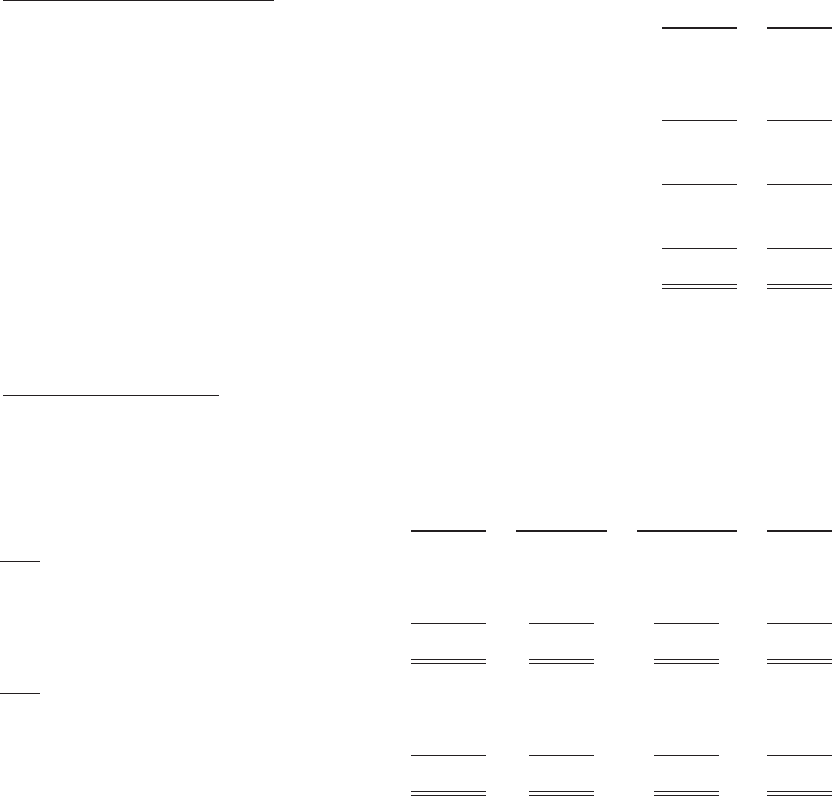

(3) Property, Plant and Equipment

2015 2014

Land and improvements ........................................... $ 3,954 6,784

Buildings and improvements ........................................ 176,982 234,149

Machinery, equipment and software .................................. 350,471 447,434

531,407 688,367

Less accumulated depreciation ...................................... 363,601 508,600

167,806 179,767

Tools, dies and molds, net of accumulated depreciation .................. 69,721 57,722

Total property, plant and equipment, net .............................. $237,527 237,489

Expenditures for maintenance and repairs which do not materially extend the life of the assets are charged to

operations as incurred.

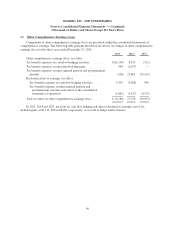

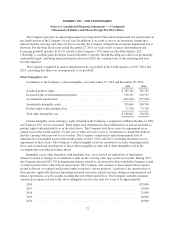

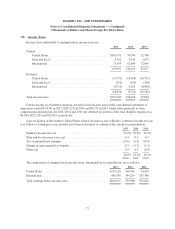

(4) Goodwill and Intangibles

Goodwill

Changes in the carrying amount of goodwill, by operating segment, for the years ended December 27, 2015

and December 28, 2014 are as follows:

U.S. and

Canada International

Entertainment

and Licensing Total

2015

Balance at December 28, 2014 ............. $296,978 170,853 125,607 593,438

Foreign exchange translation .............. — (743) — (743)

Balance at December 27, 2015 ............. $296,978 170,110 125,607 592,695

2014

Balance at December 29, 2013 ............. $296,978 171,736 125,607 594,321

Foreign exchange translation .............. — (883) — (883)

Balance at December 28, 2014 ............. $296,978 170,853 125,607 593,438

A portion of the Company’s goodwill and other intangible assets reside in the Corporate segment of the

business. For purposes of the goodwill impairment testing, these assets are allocated to the reporting units within

the Company’s operating segments.

71