Hasbro 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

certain financial covenants setting forth leverage and coverage requirements, and certain other limitations typical

of an investment grade facility, including with respect to liens, mergers and incurrence of indebtedness. The

Company was in compliance with all covenants as of and for the year ended December 27, 2015.

The Company pays a commitment fee (0.15% as of December 27, 2015) based on the unused portion of the

facility and interest equal to a Base Rate or Eurocurrency Rate plus a spread on borrowings under the facility.

The Base Rate is determined based on either the Federal Funds Rate plus a spread, Prime Rate or Eurocurrency

Rate plus a spread. The commitment fee and the amount of the spread to the Base Rate or Eurocurrency Rate

both vary based on the Company’s long-term debt ratings and the Company’s leverage. At December 27, 2015,

the interest rate under the facility was equal to Eurocurrency Rate plus 1.25%.

The Company has an agreement with a group of banks providing a commercial paper program (the

“Program”). Under the Program, at the Company’s request the banks may either purchase from the Company, or

arrange for the sale by the Company of, unsecured commercial paper notes. Borrowings under the Program are

supported by the aforementioned unsecured committed line of credit and the Company may issue notes from time

to time up to an aggregate principal amount outstanding at any given time of $700,000. The maturities of the

notes may vary but may not exceed 397 days. Subject to market conditions, the notes will be sold under

customary terms in the commercial paper market and will be issued at a discount to par, or alternatively, will be

sold at par and will bear varying interest rates based on a fixed or floating rate basis. The interest rates will vary

based on market conditions and the ratings assigned to the notes by the credit rating agencies at the time of

issuance. At December 27, 2015, the Company had notes outstanding under the Program of $160,000 with a

weighted average interest rate of 0.61%. At December 28, 2014, the Company had notes outstanding under the

Program of $239,993 with a weighted average interest rate of 0.44%.

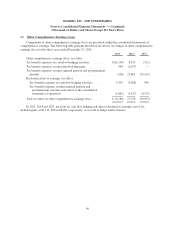

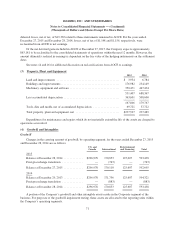

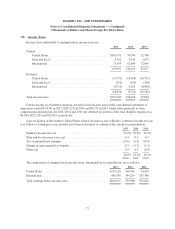

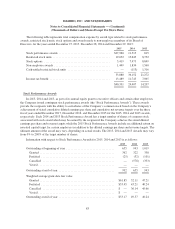

(8) Accrued Liabilities

Components of accrued liabilities are as follows:

2015 2014

Royalties ....................................................... $127,557 83,217

Advertising ..................................................... 60,196 78,530

Payroll and management incentives .................................. 93,578 82,774

Dividends ...................................................... 57,406 53,619

Other .......................................................... 320,137 308,514

Total accrued liabilities ............................................ $658,874 606,654

75