Hasbro 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

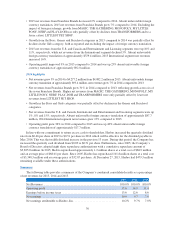

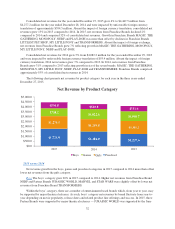

2015 release of JURASSIC WORLD, MARVEL was supported by the May 2015 release of AVENGERS: AGE

OF ULTRON and STAR WARS was supported by the December 2015 release of STAR WARS: THE FORCE

AWAKENS. These benefits were partially offset by lower 2015 net revenues from Franchise Brand

TRANSFORMERS in a non-movie year as compared to 2014 with the June theatrical release of

TRANSFORMERS: AGE OF EXTINCTION.

Games The games category grew 1% in 2015 compared to 2014. Higher net revenues resulted from

Franchise Brands MAGIC: THE GATHERING and MONOPOLY as well as from other games brands,

including, but not limited to, PIE FACE, DUEL MASTERS, DUNGEONS & DRAGONS, LIFE, OUIJA, RISK,

RUBIKS, TROUBLE and YAHTZEE. These higher net revenues were almost wholly offset by lower net

revenues from various other games brands, including, but not limited to, ELEFUN & FRIENDS, JENGA and

TABOO.

Girls The girls’ category declined 22% in 2015 compared to 2014, primarily due to expected lower net

revenues from FURBY products, as well as declines in MY LITTLE PONY, NERF REBELLE and LITTLEST

PET SHOP. Core MY LITTLE PONY revenues increased but were, however, more than offset by lower net

revenues from the MY LITTLE PONY EQUESTRIA GIRLS products. These declines were only partially offset

by the first full year of net revenues from the PLAY-DOH DOH VINCI brand, the 2015 introduction of the

DISNEY’S DESCENDANTS product line and initial shipments of DISNEY PRINCESS and FROZEN products

which became available at retail in January 2016.

Preschool The preschool category grew 17% in 2015 compared to 2014. Higher net revenues from

Franchise Brand PLAY-DOH and Partner Brands JURASSIC WORLD and STAR WARS were only partially

offset by lower revenues from the Company’s core PLAYSKOOL product line. Consistent with the boys’

category, preschool category net revenues from Partner Brands benefited from the strong theatrical line-up

discussed above.

2014 versus 2013

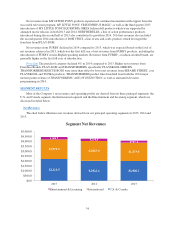

Net revenue growth in the boys and girls categories in 2014 compared to 2013 more than offset lower net

revenues from the games and preschool categories.

Boys The boys’ category grew 20% in 2014 compared to 2013. Higher net revenues from Franchise Brands

TRANSFORMERS and NERF and Partner Brand MARVEL were partially offset by expected lower net sales of

BEYBLADE products. To a lesser extent, net sales from STAR WARS products also contributed to boys’

category growth in 2014.

2014 boys category growth reflects successful execution of Hasbro’s Franchise Brand-focused strategy in

conjunction with its brand blueprint. Net revenues from Franchise Brand TRANSFORMERS products benefited

from higher net revenues, including higher product sales and royalty income, related to products based on the

2014 major motion picture release of TRANSFORMERS: AGE OF EXTINCTION, as well as animated television

programming in 2014 and 2013.

Sales of MARVEL products, primarily SPIDER-MAN and AVENGERS products, increased in 2014

compared to 2013. SPIDER-MAN was supported by the 2014 major motion picture release of THE AMAZING

SPIDER-MAN 2. 2014 net revenues also included sales related to the 2014 theatrical releases of CAPTAIN

AMERICA: THE WINTER SOLIDIER and GUARDIANS OF THE GALAXY.

Games The games category declined 4% in 2014 compared to 2013. Growth from Franchise Brands

MAGIC: THE GATHERING and MONOPOLY as well as other games brands, including SIMON, specifically

SIMON SWIPE, THE GAME OF LIFE, TROUBLE and DUNGEONS & DRAGONS were more than offset by

lower net revenues from other games brands, primarily DUEL MASTERS, ANGRY BIRDS and TWISTER.

Girls The girls category grew 2% in 2014 compared to 2013, primarily related to higher net revenues from

Franchise Brands, MY LITTLE PONY and NERF REBELLE, partially offset by lower net revenues from

Franchise Brand LITTLEST PET SHOP and Challenger Brands FURBY and FURREAL FRIENDS.

33