Hasbro 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entertainment and Licensing

2015 versus 2014

Entertainment and Licensing segment net revenues increased 11% in 2015 compared to 2014. Higher

entertainment revenues related to a multi-year digital distribution agreement for Hasbro Studios programming as

well as slightly higher net revenues from the Company’s consumer product and digital gaming licensing groups

were only partially offset by lower net revenues from Backflip.

2014 versus 2013

Entertainment and Licensing segment net revenues increased 15% in 2014 compared to 2013. The increase

in net revenues in 2014 compared to 2013 were primarily related to higher consumer products licensing revenue,

along with contributions from digital gaming and a full year of net revenues from Backflip, of which a 70%

interest was acquired during the third quarter of 2013. Partially offsetting these increases was lower television

programming and film revenue. Higher royalty income included growth in TRANSFORMERS and MY LITTLE

PONY.

Operating Profit

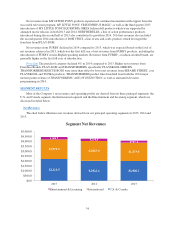

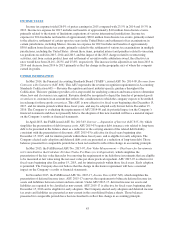

The table below illustrates operating profit and operating profit margins derived from our principal

operating segments in 2015, 2014 and 2013. For information, see Note 19 to our consolidated financial

statements which are included in Item 8 of this Form 10-K.

2015

% Net

Revenues

%

Change 2014

% Net

Revenues

%

Change 2013

% Net

Revenues

U.S. and Canada ............... $430.7 19.4% 29% $334.7 16.5% 7% $313.7 15.6%

International .................. 255.4 13.0% -6% 270.5 13.4% 15% 235.5 12.6%

Entertainment & Licensing ...... 76.9 31.4% 27% 60.6 27.6% 33% 45.5 23.8%

U.S. and Canada

2015 versus 2014

U.S. and Canada segment operating profit increased 29% in 2015 compared to 2014. Higher operating profit

reflects higher net revenues discussed above as well as product mix and lower intangible amortization, partially

offset by higher overheads and shipping and warehousing costs. Operating profit margin improved to 19.4% of

net revenues in 2015 from 16.5% of net revenues in 2014. Improved operating profit margin reflects both

revenue volume and product mix, including lower advertising as a percentage of net revenues. Foreign currency

translation did not have a material impact on U.S. and Canada operating profit in 2015.

2014 versus 2013

U.S. and Canada operating profit increased 7% in 2014 compared to 2013 and operating profit margin improved

to 16.5% in 2014 from 15.6% in 2013. The improvement in operating profit and operating profit margin was the result

of higher net revenues and improved product mix, as well as lower shipping and distribution costs. Foreign currency

translation did not have a material impact on U.S. and Canada operating profit in 2014.

International

2015 versus 2014

International segment operating profit decreased 6% in 2015 compared to 2014 and included an unfavorable

impact from foreign exchange of $46.7 million. Absent the impact of unfavorable foreign currency translation,

International segment operating profit grew 12%. The decline in operating profit, as reported, is primarily due to

lower net revenues, partially offset by lower advertising, shipping and warehousing, and intangible amortization.

Operating profit margin decreased to 13.0% in 2015 from 13.4% in 2014. The decrease in segment operating

profit margin reflects lower net revenues and higher overhead costs, partially offset by lower advertising and

shipping and warehousing costs.

37