Hasbro 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

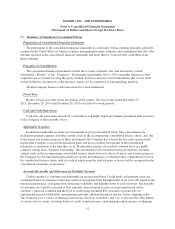

The Economy and Inflation

The principal market for the Company’s products is the retail sector. Revenues from the Company’s top five

customers, all retailers, accounted for approximately 39% of its consolidated net revenues in 2015 and 38% and

39% of its consolidated net revenues in 2014 and 2013, respectively. The Company monitors the

creditworthiness of its customers and adjusts credit policies and limits as it deems appropriate.

The Company’s revenue pattern continues to show the second half of the year to be more significant to its

overall business for the full year. In 2015, approximately 66% of the Company’s full year net revenues were

recognized in the second half of the year. The Company expects that this concentration will continue. The

concentration of sales in the second half of the year increases the risk of (a) underproduction of popular items,

(b) overproduction of less popular items, and (c) failure to achieve tight and compressed shipping schedules. The

business of the Company is characterized by customer order patterns which vary from year to year largely

because of differences in the degree of consumer acceptance of a product line, product availability, marketing

strategies, inventory levels, policies of retailers and differences in overall economic conditions. Larger retailers

generally maintain lower inventories throughout the year and purchase a greater percentage of product within or

close to the fourth quarter holiday consumer buying season, which includes Christmas.

Quick response inventory management practices being used by retailers result in orders increasingly placed

for immediate delivery and fewer orders placed well in advance of shipment. Retailers are timing their orders so

that they are filled by suppliers closer to the time of purchase by consumers. To the extent that retailers do not

sell as much of their year-end inventory purchases during this holiday selling season as they had anticipated, their

demand for additional product earlier in the following fiscal year may be curtailed, thus negatively impacting the

Company’s future revenues. In addition, the bankruptcy or other lack of success of one of the Company’s

significant retailers could negatively impact the Company’s future revenues.

The effect of inflation on the Company’s operations during 2015 was not significant and the Company will

continue its practice of monitoring costs and adjusting prices, accordingly.

Other Information

The Company is not aware of any material amounts of potential exposure relating to environmental matters

and does not believe its environmental compliance costs or liabilities to be material to its operating results or

financial position.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

The information required by this item is included in Item 7 of Part II of this Report and is incorporated

herein by reference.

54