Hasbro 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

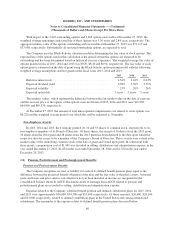

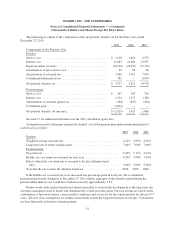

At December 27, 2015 and December 28, 2014, the fair value of the Company’s undesignated derivative

financial instruments are recorded to accrued liabilities in the consolidated balance sheets as follows:

2015 2014

Accrued liabilities

Unrealized gains .............................................................. $ 416 1,733

Unrealized losses ............................................................. (1,460) (4,046)

Net unrealized loss ............................................................ $(1,044) (2,313)

The Company recorded net gains (losses) of $48,489, $(32,106) and $(8,791) on these instruments to other

(income) expense, net for 2015, 2014 and 2013, respectively, relating to the change in fair value of such

derivatives, substantially offsetting gains and losses from the change in fair value of intercompany loans to which

the instruments relate.

For additional information related to the Company’s derivative financial instruments see notes 2, 9 and 12.

(17) Sale of Manufacturing Operations

On August 30, 2015, the Company completed the sale of its manufacturing operations to Cartamundi NV

(“Cartamundi”) for approximately $54,400, approximately $18,600 of which was received on the date of sale

with the remainder to be paid in 5 annual installments. Under the terms of the purchase and sale agreement,

Cartamundi acquired the inventory and property, plant and equipment related to manufacturing operations in East

Longmeadow, MA and the common stock of the Company’s manufacturing subsidiary in Waterford, Ireland.

Inclusive of this transaction and other related costs, the Company recognized a gain of $6,573 on the sale

recorded in other (income) expense, net in the consolidated statements of operations. These operations were a

component of the Company’s Global Operations segment.

In connection with this transaction, the Company also entered into a manufacturing services agreement

under which Cartamundi will provide manufacturing services over a 5-year term. In connection with this

agreement, the Company has agreed to minimum purchase commitments from Cartamundi over the term of the

agreement. The Company and Cartamundi are also party to a warehousing agreement under which the Company

leases designated warehouse space at the East Longmeadow, MA location, as well as a transition services

agreement related to certain administrative functions each party is providing each other during a defined

transition period. In connection with this transaction, the Company froze the benefits of one of its funded defined

benefit pension plans covering union employees. In connection with these actions, the Company recognized a net

curtailment benefit of $3,061 related to net prior service credits in the related defined benefit pension and post-

retirement plans. This benefit is recorded in selling, distribution and administration expenses in the consolidated

statements of operations. The Company has retained the frozen defined benefit pension plans related to its former

employees of its East Longmeadow, MA and Waterford, Ireland businesses.

(18) Commitments and Contingencies

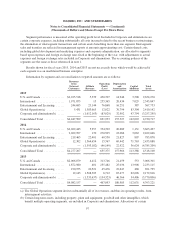

Hasbro had unused open letters of credit and related instruments of approximately $24,444 and $167,117 at

December 27, 2015 and December 28, 2014, respectively. Included in the amount for 2014, was $146,410 of

bonds related to tax assessments in Mexico which were settled in December 2014. See note 10 for additional

discussion.

The Company enters into license agreements with strategic partners, inventors, designers and others for the

use of intellectual properties in its products. Certain of these agreements contain provisions for the payment of

guaranteed or minimum royalty amounts. Under terms of existing agreements as of December 27, 2015, Hasbro

95