Hasbro 2015 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

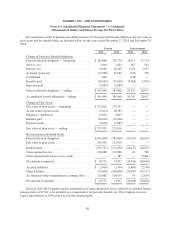

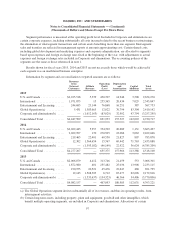

Segment performance is measured at the operating profit level. Included in Corporate and eliminations are

certain corporate expenses, including substantially all costs incurred related to the recent business restructurings,

the elimination of intersegment transactions and certain assets benefiting more than one segment. Intersegment

sales and transfers are reflected in management reports at amounts approximating cost. Certain shared costs,

including global development and marketing expenses and corporate administration, are allocated to segments

based upon expenses and foreign exchange rates fixed at the beginning of the year, with adjustments to actual

expenses and foreign exchange rates included in Corporate and eliminations. The accounting policies of the

segments are the same as those referenced in note 1.

Results shown for fiscal years 2015, 2014 and 2013 are not necessarily those which would be achieved if

each segment was an unaffiliated business enterprise.

Information by segment and a reconciliation to reported amounts are as follows:

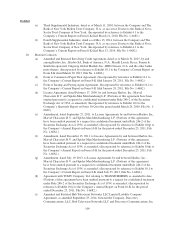

Revenues

from

External

Customers

Affiliate

Revenue

Operating

Profit

(Loss)

Depreciation

and

Amortization

Capital

Additions

Total

Assets

2015

U.S. and Canada ................ $2,225,518 5,339 430,707 14,946 3,508 2,654,270

International ................... 1,971,875 15 255,365 20,434 7,029 2,345,847

Entertainment and Licensing ...... 244,685 23,144 76,868 16,251 387 567,753

Global Operations(a) ............ 5,431 1,583,665 12,022 70,794 83,304 2,410,142

Corporate and eliminations(b) ..... — (1,612,163) (83,029) 32,902 47,794 (3,257,295)

Consolidated Total .............. $4,447,509 — 691,933 155,327 142,022 4,720,717

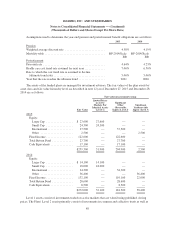

2014

U.S. and Canada ................ $2,022,443 5,957 334,702 20,689 1,131 3,663,497

International ................... 2,022,997 170 270,505 23,086 3,063 2,422,046

Entertainment and Licensing ...... 219,465 22,401 60,550 21,827 807 783,878

Global Operations(a) ............ 12,302 1,564,654 15,767 69,442 71,763 2,433,888

Corporate and eliminations(b) ..... — (1,593,182) (46,149) 22,922 36,624 (4,785,209)

Consolidated Total .............. $4,277,207 — 635,375 157,966 113,388 4,518,100

2013

U.S. and Canada ................ $2,006,079 4,412 313,746 21,459 553 3,066,301

International ................... 1,872,980 401 235,482 25,036 13,908 2,233,115

Entertainment and Licensing ...... 190,955 20,521 45,476 22,647 468 691,795

Global Operations(a) ............ 12,143 1,508,303 6,712 65,477 62,696 2,172,816

Corporate and eliminations(b) ..... — (1,533,637) (134,323) 46,366 34,406 (3,770,806)

Consolidated Total .............. $4,082,157 — 467,093 180,985 112,031 4,393,221

(a) The Global Operations segment derives substantially all of its revenues, and thus its operating results, from

intersegment activities.

(b) Certain long-term assets, including property, plant and equipment, goodwill and other intangibles, which

benefit multiple operating segments, are included in Corporate and eliminations. Allocations of certain

97