Hasbro 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

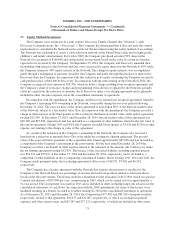

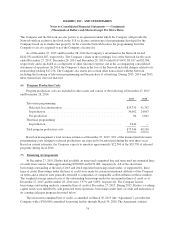

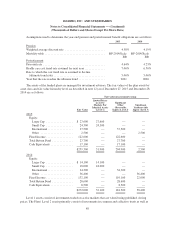

The cumulative amount of undistributed earnings of Hasbro’s international subsidiaries held for indefinite

reinvestment is approximately $2,219,000 at December 27, 2015. In the event that all international undistributed

earnings were remitted to the United States, the amount of incremental taxes would be approximately $548,000.

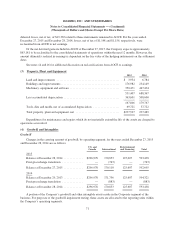

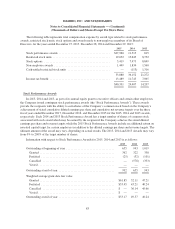

(11) Capital Stock

In February 2015 the Company’s Board of Directors authorized the repurchases of up to $500,000 in

common stock after seven previous authorizations dated May 2005, July 2006, August 2007, February

2008, April 2010, May 2011 and August 2013 with a cumulative authorized repurchase amount of $3,325,000

were fully utilized. Purchases of the Company’s common stock may be made from time to time, subject to

market conditions, and may be made in the open market or through privately negotiated transactions. The

Company has no obligation to repurchase shares under the authorization and the time, actual number, and the

value of the shares which are repurchased will depend on a number of factors, including the price of the

Company’s common stock. In 2015, the Company repurchased 1,248 shares at an average price of $68.01. The

total cost of these repurchases, including transaction costs, was $84,894. At December 27, 2015, $479,283

remained under the current authorizations.

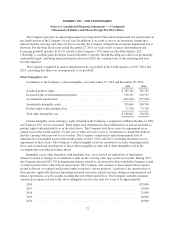

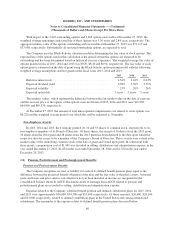

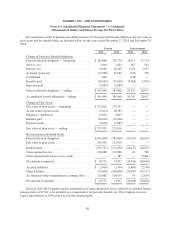

(12) Fair Value of Financial Instruments

The Company measures certain assets at fair value in accordance with current accounting standards. The fair

value hierarchy consists of three levels: Level 1 fair values are valuations based on quoted market prices in active

markets for identical assets or liabilities that the entity has the ability to access; Level 2 fair values are those

valuations based on quoted prices for similar assets or liabilities, quoted prices in markets that are not active, or

other inputs that are observable or can be corroborated by observable data for substantially the full term of the

assets or liabilities; and Level 3 fair values are valuations based on inputs that are supported by little or no market

activity and that are significant to the fair value of the assets or liabilities. There have been no transfers between

levels within the fair value hierarchy.

Current accounting standards permit entities to choose to measure many financial instruments and certain

other items at fair value and establish presentation and disclosure requirements designed to facilitate comparisons

between entities that choose different measurement attributes for similar assets and liabilities. The Company has

elected the fair value option for certain investments. At December 27, 2015 and December 28, 2014, these

investments totaled $22,539 and $23,560, respectively, and are included in prepaid expenses and other current

assets in the consolidated balance sheets. The Company recorded net (losses) gains of $(682), $889 and $152 on

these investments in other (income) expense, net for the years ended December 27, 2015, December 28, 2014 and

December 29, 2013, respectively, relating to the change in fair value of such investments.

80