Hasbro 2015 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

expenses related to these assets to the individual operating segments are done at the beginning of the year

based on budgeted amounts. Any differences between actual and budgeted amounts are reflected in Corporate

and eliminations. Furthermore, Corporate and eliminations includes elimination of inter-company income

statement transactions. One such example includes licensing and service arrangements with affiliates.

Payments received in advance from affiliates are recognized as revenue and eliminated in consolidation as

earned and payment becomes assured over the life of the contract. During 2015 and 2014, affiliate licensing

and service fees of $265,595 and $541,036, respectively, that were received in 2014 and 2013, respectively,

were recognized as revenue and eliminated in consolidation. Corporate and eliminations also includes the

elimination of inter-company balance sheet amounts.

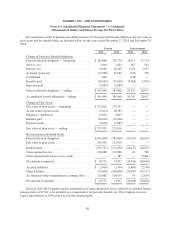

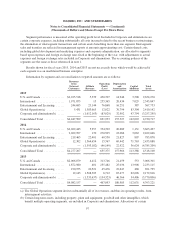

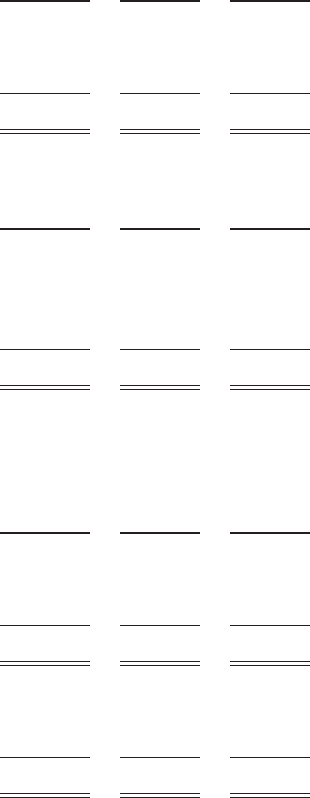

The following table represents consolidated International segment net revenues by major geographic region

for the three fiscal years ended December 27, 2015.

2015 2014 2013

Europe ........................................... $1,236,846 1,258,078 1,190,350

Latin America ..................................... 426,109 463,512 407,710

Asia Pacific ....................................... 308,920 301,407 274,920

Net revenues ...................................... $1,971,875 2,022,997 1,872,980

The following table presents consolidated net revenues by classes of principal products for the three fiscal

years ended December 27, 2015.

2015 2014 2013

Boys ............................................. $1,775,917 1,483,952 1,237,611

Games ........................................... 1,276,532 1,259,782 1,311,205

Girls ............................................. 798,240 1,022,633 1,001,704

Preschool ......................................... 596,820 510,840 531,637

Net revenues ...................................... $4,447,509 4,277,207 4,082,157

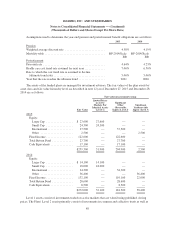

Information as to Hasbro’s operations in different geographical areas is presented below on the basis the

Company uses to manage its business. Net revenues are categorized based on location of the customer, while

long-lived assets (property, plant and equipment, goodwill and other intangibles) are categorized based on their

location.

2015 2014 2013

Net revenues

United States .................................... $2,278,613 2,040,476 1,960,477

International .................................... 2,168,896 2,236,731 2,121,680

$4,447,509 4,277,207 4,082,157

Long-lived assets

United States .................................... $ 932,790 977,035 1,021,063

International .................................... 178,239 178,420 185,520

$1,111,029 1,155,455 1,206,583

98