Hasbro 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

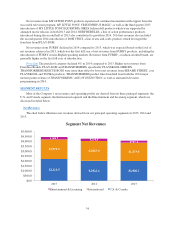

U.S. and Canada

2015 versus 2014

U.S. and Canada segment net revenues grew 10% in 2015 compared to 2014 and were impacted by

unfavorable foreign currency translation of $14.3 million. Absent the impact of foreign currency, U.S. and

Canada segment net revenues grew 11%. Higher net revenues from the boys’, games and preschool categories

were partially offset by lower net revenues from the girls’ category.

In the boys’ category, higher net revenues from NERF, JURASSIC WORLD and STAR WARS products

were slightly offset by lower net revenues from TRANSFORMERS and BEYBLADE products. In the games

category, higher net revenues from PIE FACE, MAGIC: THE GATHERING, DUEL MASTERS, JENGA and

RUBIKS were only partially offset by lower net revenues from other game brands including ELEFUN &

FRIENDS and CHUTES AND LADDERS products. In the girls’ category, higher net revenues from DISNEY’S

DESCENDANTS, and, to a lesser extent, LITTLEST PET SHOP and initial shipments of DISNEY PRINCESS

were more than offset by lower net revenues from MY LITTLE PONY, NERF, and FURBY products. In the

preschool category, higher net revenues from PLAY-DOH, JURASSIC WORLD and STAR WARS products

were slightly offset by lower net revenues from TRANSFORMERS and core PLAYSKOOL products.

2014 versus 2013

U.S. and Canada segment net revenues grew 1% in 2014 compared to 2013 and were impacted by

unfavorable foreign currency translation of $5.5 million. Higher net revenues from the boys’ category were

almost wholly offset by lower net revenues from the games, girls’ and preschool categories.

In the boys’ category, higher net revenues from TRANSFORMERS, NERF, MARVEL and STAR WARS

in 2014 compared to 2013 were only partially offset by expected lower sales of BEYBLADE products. In the

games category, higher net revenues from Franchise Brands, specifically MAGIC: THE GATHERING and

MONOPOLY, as well as other games brands, were more than offset by lower net revenues from DUEL

MASTERS and TWISTER, and certain other game brands. In the girls’ category, higher net revenues from

Franchise Brands LITTLEST PET SHOP, MY LITTLE PONY, NERF and PLAY-DOH, as well as higher net

revenues from FURREAL FRIENDS, were more than offset by an expected decline in net revenues from

FURBY products. In the preschool category, higher net revenues from the Franchise Brands PLAY-DOH and

TRANSFORMERS were more than offset by lower net sales from core PLAYSKOOL as well as key partner

brands, particularly SESAME STREET, MARVEL and STAR WARS.

International

Considering the significant changes in foreign currency, discussing fluctuations in International segment net

revenue absent the impact of foreign currency translation provides a more meaningful explanation of the

segment’s results. To calculate the year-over-year percentage change in net revenues absent the impact of foreign

currency translation, net revenues were recalculated using those foreign currency translation rates in place for the

prior year’s comparable period.

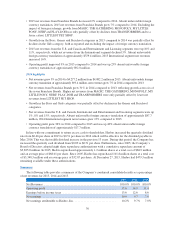

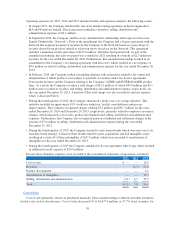

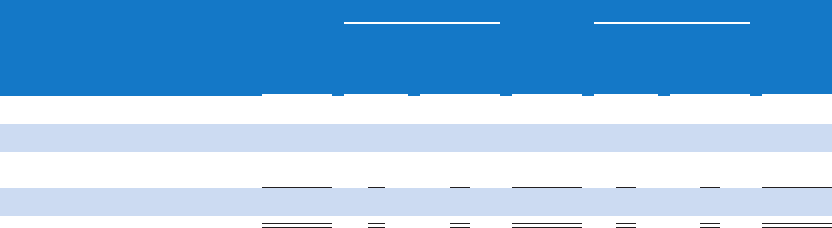

The table below presents International segment net revenues by geographic region as well as the year-over-

year percentage change including and excluding the impact of foreign currency translation.

2015

% Change % Change

As

Reported

Absent

Foreign

Currency

Translation 2014

As

Reported

Absent

Foreign

Currency

Translation 2013

Europe ................... $1,236.8 -2% 18% $1,258.1 6% 11% $1,190.4

Latin America ............. 426.1 -8% 15% 463.5 14% 19% 407.7

Asia Pacific ............... 308.9 2% 11% 301.4 10% 11% 274.9

Net Revenues ............. $1,971.9 -3% 16% $2,023.0 8% 13% $1,873.0

35