Hasbro 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

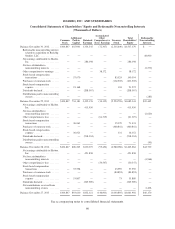

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

are presented as a separate line on the consolidated statements of operations which is necessary to identify those

earnings specifically attributable to Hasbro.

Presently, the Company has one investment with a redeemable noncontrolling interest which is the

Company’s 70% majority interest in Backflip Studios, LLC (“Backflip”). The Company may be required to

purchase the remaining 30% in the future contingent on the achievement by Backflip of certain predetermined

financial performance metrics (the “metrics”). Because the Company does not know the ultimate timing that

these metrics may be met and, thereby, cannot currently estimate the purchase price of the remaining 30%, the

value reported reflects the fair value of the redeemable noncontrolling interest on the date of acquisition which

has been adjusted for cumulative earnings (losses) attributable to the noncontrolling interest since the date of

acquisition as well as capital contributions made by or distributions made to the noncontrolling interest since the

acquisition.

Property, Plant and Equipment, Net

Property, plant and equipment are stated at cost less accumulated depreciation. Depreciation is computed

using accelerated and straight-line methods to depreciate the cost of property, plant and equipment over their

estimated useful lives. The principal lives, in years, used in determining depreciation rates of various assets are:

land improvements 15 to 19, buildings and improvements 15 to 25 and machinery and equipment (including

computer hardware and software) 3 to 12. Depreciation expense is classified in the consolidated statements of

operations based on the nature of the property and equipment being depreciated. Tools, dies and molds are

depreciated over a three-year period or their useful lives, whichever is less, using an accelerated method. The

Company generally owns all tools, dies and molds related to its products.

Property, plant and equipment, net is reviewed for impairment whenever events or circumstances indicate

the carrying value may not be recoverable. Recoverability is measured by a comparison of the carrying amount

of the asset to future undiscounted cash flows expected to be generated by the asset or asset group. If such assets

are considered to be impaired, the impairment to be recognized would be measured by the amount by which the

carrying value of the assets exceeds their fair value wherein the fair value is the appraised value. Furthermore,

assets to be disposed of are carried at the lower of the net book value or their estimated fair value less disposal

costs.

Goodwill and Other Intangibles, Net

Goodwill results from acquisitions the Company has made over time. Substantially all of the other

intangibles consist of the cost of acquired product rights. In establishing the value of such rights, the Company

considers existing trademarks, copyrights, patents, license agreements and other product-related rights. These

rights were valued on their acquisition date based on the anticipated future cash flows from the underlying

product line. The Company has certain intangible assets related to the Tonka and Milton Bradley acquisitions

that have an indefinite life.

Goodwill and intangible assets deemed to have indefinite lives are not amortized and are tested for

impairment at least annually. The annual test begins with goodwill and all intangible assets being allocated to

applicable reporting units. This quantitative two-step process begins with an estimation of fair value of the

reporting unit using an income approach, which looks to the present value of expected future cash flows. The

first step is a screen for potential impairment while the second step measures the amount of impairment if there is

an indication from the first step that one exists. When performing the quantitative two-step impairment test,

goodwill and intangible assets with indefinite lives are tested for impairment by comparing their carrying value

to their estimated fair value, also calculated using the present value of expected future cash flows.

63