Hasbro 2015 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

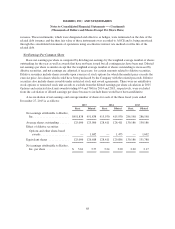

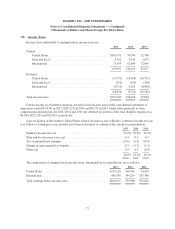

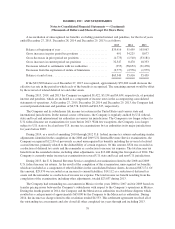

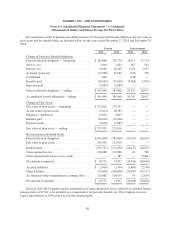

The components of deferred income tax expense (benefit) arise from various temporary differences and

relate to items included in the consolidated statements of operations as well as items recognized in other

comprehensive earnings. The tax effects of temporary differences that give rise to significant portions of the

deferred tax assets and liabilities at December 27, 2015 and December 28, 2014 are:

2015 2014

Deferred tax assets:

Accounts receivable .............................................. $ 23,568 20,874

Inventories ...................................................... 15,168 14,698

Loss and credit carryforwards ....................................... 28,893 32,393

Operating expenses ............................................... 43,029 48,998

Pension ........................................................ 49,746 53,789

Other compensation ............................................... 62,587 48,498

Postretirement benefits ............................................ 9,253 10,092

Interest rate hedge ................................................ 10,937 11,638

Tax sharing agreement ............................................ 18,379 18,840

Other .......................................................... 31,441 27,817

Gross deferred tax assets ........................................... 293,001 287,637

Valuation allowance .............................................. (23,593) (26,319)

Net deferred tax assets ............................................. 269,408 261,318

Deferred tax liabilities:

Depreciation and amortization of long-lived assets ...................... 53,755 59,895

Equity method investment .......................................... 8,205 2,001

Other .......................................................... 16,632 13,447

Deferred tax liabilities ............................................. 78,592 75,343

Net deferred income taxes .......................................... $190,816 185,975

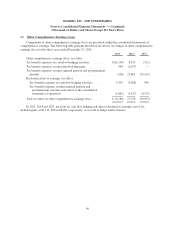

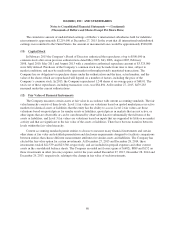

Hasbro has a valuation allowance for certain deferred tax assets at December 27, 2015 of $23,593, which is

a decrease of $2,726 from $26,319 at December 28, 2014. The valuation allowance pertains to certain U.S. state

and international loss and credit carryforwards, some of which have no expiration and others that would expire

beginning in 2016.

Based on Hasbro’s history of taxable income and the anticipation of sufficient taxable income in years when

the temporary differences are expected to become tax deductions, the Company believes that it will realize the

benefit of the deferred tax assets, net of the existing valuation allowance.

At December 27, 2015 and December 28, 2014, the Company’s net deferred income taxes are recorded in

the consolidated balance sheets as follows:

2015 2014

Other assets ..................................................... $199,563 193,875

Other liabilities .................................................. (8,747) (7,900)

Net deferred income taxes .......................................... $190,816 185,975

78