Hasbro 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company has a revolving credit agreement (the “Agreement”) which provides the Company with a

$700.0 million committed borrowing facility. The Agreement contains certain financial covenants setting forth

leverage and coverage requirements, and certain other limitations typical of an investment grade facility,

including with respect to liens, mergers and incurrence of indebtedness. The Company was in compliance with

all covenants in the Agreement as of and for the fiscal year ended December 27, 2015. The Company had no

borrowings outstanding under its committed revolving credit facility at December 27, 2015. However, letters of

credit outstanding under this facility as of December 27, 2015 were approximately $0.8 million. Amounts

available and unused under the committed line at December 27, 2015 were approximately $539.2 million,

inclusive of borrowings under the Company’s commercial paper program. The Company also has other

uncommitted lines from various banks, of which approximately $28.3 million was utilized at December 27, 2015.

Of the amount utilized under, or supported by, the uncommitted lines, approximately $4.6 million and $23.7

million represent outstanding short-term borrowings and letters of credit, respectively.

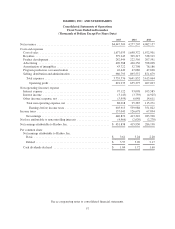

Net cash utilized by financing activities was $346.5 million, $231.0 million and $341.0 million in 2015,

2014 and 2013, respectively. The 2014 utilization includes net proceeds from the issuance and repayment of

long-term debt totaling $135.0 million. In 2014, the Company issued an aggregate $600.0 million in long-term

notes which were partially utilized to re-pay the $425.0 million in long-term notes due in May 2014. Of the

amounts utilized in 2015, 2014 and 2013, $87.2 million, $459.6 million and $103.5 million, respectively, reflects

cash paid, including transaction costs, to repurchase the Company’s common stock, respectively. During 2015,

2014 and 2013, the Company repurchased 1.2 million, 8.5 million and 2.3 million shares, respectively, at an

average price of $68.01, $54.26 and $45.17. At December 27, 2015, $479.3 million remained under outstanding

Board authorizations. Dividends paid were $225.8 million in 2015 compared to $216.9 million in 2014 and

$156.1 million in 2013. Dividends paid in 2013 includes only three quarterly payments resulting from a decision

by the Company’s Board to accelerate the payment of the dividend declared in December 2012, which

historically would have been paid in February 2013, to December 2012. This acceleration resulted in one less

quarterly dividend paid in 2013. Further, the Company has increased its quarterly dividend rate from $0.40 in

2013 to $0.43 in 2014 and $0.46 in 2015. Proceeds from short-term borrowings of $246.1 million in 2014

compared to repayments of short-term borrowings of $87.3 million in 2015 and $215.3 million in 2013. The

Company generated cash from employee stock option transactions of $57.6 million, $71.4 million and $140.4

million in 2015, 2014 and 2013, respectively.

For the $350.0 million in notes due in 2017 which bear interest at 6.30%, interest rates may be adjusted

upward in the event that the Company’s credit rating from Moody’s Investor Services, Inc., Standard & Poor’s

Ratings Services or Fitch Ratings is reduced to Ba1, BB+, or BB+, respectively, or below. At December 27,

2015, the Company’s ratings from Moody’s Investor Services, Inc., Standard & Poor’s Ratings Services and

Fitch Ratings were Baa2, BBB and BBB+, respectively. The interest rate adjustment is dependent on the degree

of decrease of the Company’s ratings and could range from 0.25% to a maximum of 2.00%. The Company may

redeem the notes at its option at the greater of the principal amount of the notes or the present value of the

remaining scheduled payments discounted using the effective interest rate on applicable U.S. Treasury bills at the

time of repurchase.

Including the notes described above, the Company has principal amounts of long-term debt at December 27,

2015 of approximately $1,559.9 million due at varying times from 2017 through 2044. The Company also had

letters of credit and other similar instruments of $27.9 million and 2016 purchase commitments of $518.5 million

outstanding at December 27, 2015. In addition, the Company expects to be committed to guaranteed royalty

payments of approximately $83.6 million in 2016, including $40.0 million contingent on theatrical movie

releases.

CRITICAL ACCOUNTING POLICIES AND SIGNIFICANT ESTIMATES

The Company prepares its consolidated financial statements in accordance with accounting principles

generally accepted in the United States of America. As such, management is required to make certain estimates,

judgments and assumptions that it believes are reasonable based on information available. These estimates and

assumptions affect the reported amounts of assets and liabilities at the date of the consolidated financial

47