Hasbro 2015 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Net revenues from MY LITTLE PONY products experienced continued momentum with support from the

successful television program, MY LITTLE PONY: FRIENDSHIP IS MAGIC, as well as the third quarter 2013

introduction of MY LITTLE PONY EQUESTRIA GIRLS fashion doll products which were supported by

animated movie releases in both 2013 and 2014. NERF REBELLE, a line of action performance products,

introduced during the second half of 2013 also contributed to growth in 2014. 2014 net revenues also included

the second quarter 2014 introduction of DOH VINCI, a line of arts and crafts products which leveraged the

franchise brand PLAY-DOH.

Net revenues from FURBY declined in 2014 compared to 2013, which was expected based on the level of

net revenues achieved in 2013, which was the first full year of net revenues from FURBY products, including the

introduction of FURBY in non-English speaking markets. Revenues from FURBY, a fashion-oriented brand, are

generally higher in the first full year of introduction.

Preschool The preschool category declined 4% in 2014 compared to 2013. Higher net revenues from

Franchise Brands, PLAY-DOH and TRANSFORMERS, specifically PLAYSKOOL HEROES

TRANSFORMERS RESCUE BOTS were more than offset by lower net revenues from SESAME STREET, core

PLAYSKOOL and TONKA products. TRANSFORMERS product lines benefited from both the 2014 major

motion picture release of TRANSFORMERS: AGE OF EXTINCTION, as well as animated television

programming in 2014.

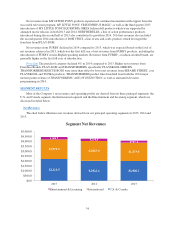

SEGMENT RESULTS

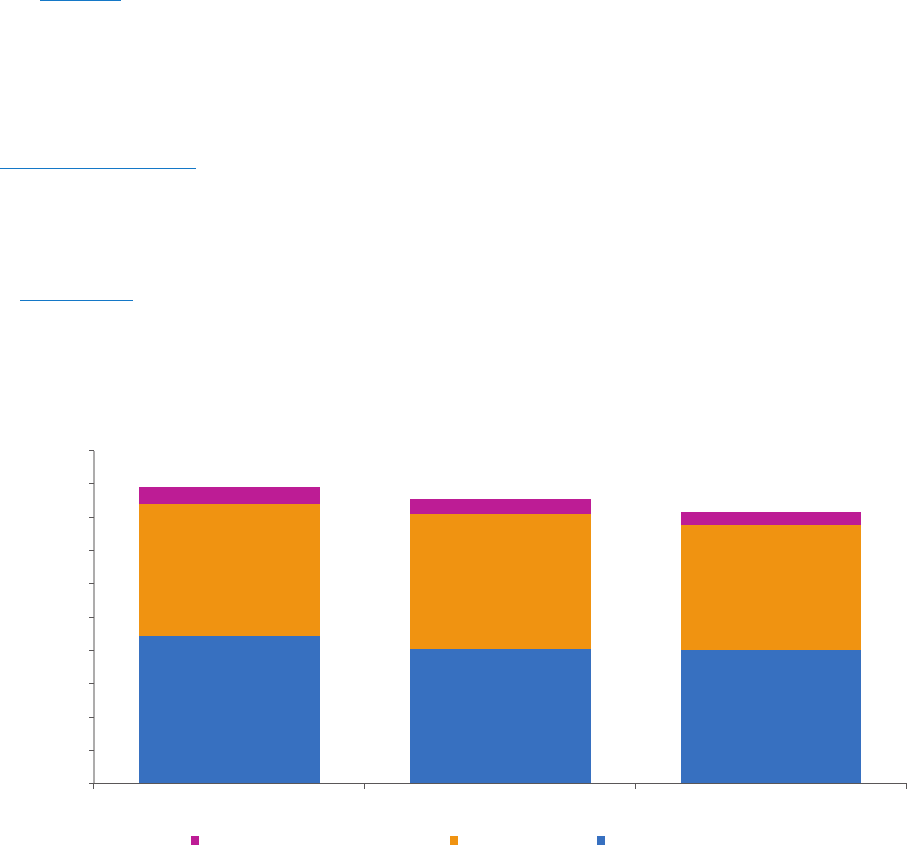

Most of the Company’s net revenues and operating profits are derived from its three principal segments: the

U.S. and Canada segment, the International segment and the Entertainment and Licensing segment, which are

discussed in detail below.

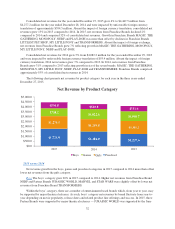

Net Revenues

The chart below illustrates net revenues derived from our principal operating segments in 2015, 2014 and

2013.

Segment Net Revenues

$5,000.0

$4,500.0

$4,000.0

$3,500.0

$3,000.0

$2,500.0

$2,000.0

$1,500.0

$1,000.0

$500.0

$0.0

2015

InternationalEntertainment & Licensing U.S. & Canada

2014 2013

$244.7 $219.5 $191.0

$1,873.0

$2,006.1

$2,023.0

$2,022.4

$1,971.9

$2,225.5

34