Hasbro 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

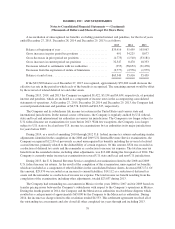

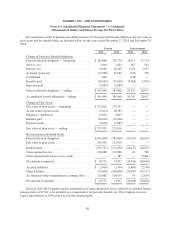

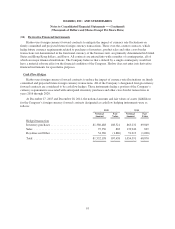

The following table represents total compensation expense by award type related to stock performance

awards, restricted stock units, stock options and awards made to non-employee members of its Board of

Directors, for the years ended December 27, 2015, December 28, 2014 and December 29, 2013:

2015 2014 2013

Stock performance awards ................................... $27,960 11,315 815

Restricted stock units ....................................... 19,052 15,643 8,732

Stock options ............................................. 5,419 7,473 8,849

Non-employee awards ...................................... 1,449 1,834 1,560

Cash-settled restricted stock units ............................. — (113) 1,316

53,880 36,152 21,272

Income tax benefit ......................................... 13,489 11,745 7,065

$40,391 24,407 14,207

Stock Performance Awards

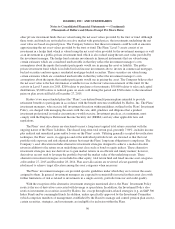

In 2015, 2014 and 2013, as part of its annual equity grant to executive officers and certain other employees,

the Company issued contingent stock performance awards (the “Stock Performance Awards”). These awards

provide the recipients with the ability to earn shares of the Company’s common stock based on the Company’s

achievement of stated cumulative diluted earnings per share and cumulative net revenue targets over the three

fiscal years ended December 2017, December 2016, and December 2015 for the 2015, 2014 and 2013 awards,

respectively. Each 2014 and 2013 Stock Performance Award has a target number of shares of common stock

associated with such award which may be earned by the recipient if the Company achieves the stated diluted

earnings per share and revenue targets while the 2015 Stock Performance Awards include an additional return on

invested capital target for certain employees in addition to the diluted earnings per share and revenue targets. The

ultimate amount of the award may vary, depending on actual results. The 2013, 2014 and 2015 Awards may vary

from 0% to 200% of the target number of shares.

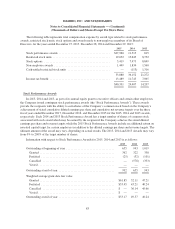

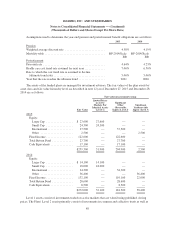

Information with respect to Stock Performance Awards for 2015, 2014 and 2013 is as follows:

2015 2014 2013

Outstanding at beginning of year ................................. 655 943 1,019

Granted ................................................... 362 322 358

Forfeited .................................................. (25) (32) (101)

Cancelled ................................................. — (578) (333)

Vested .................................................... — — —

Outstanding at end of year ...................................... 992 655 943

Weighted average grant-date fair value:

Granted ................................................... $61.85 52.11 47.21

Forfeited .................................................. $53.45 43.21 40.24

Cancelled ................................................. $ — 36.14 45.66

Vested .................................................... $ — — —

Outstanding at end of year ...................................... $53.17 49.57 40.24

83