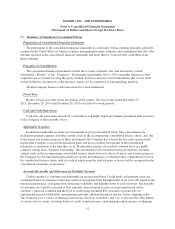

Hasbro 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

resolution of these uncertain tax positions and as such, does not know the ultimate amount or timing of

payments related to this liability.

• The Company expects to make contributions totaling approximately $3.6 million related to its unfunded

U.S. and other International pension plans in 2016.

• At December 27, 2015, the Company had letters of credit and related instruments of approximately $24.5

million.

The Company believes that cash from operations and funds available through its commercial paper program

or lines of credit will allow the Company to meet these and other obligations described above.

Financial Risk Management

The Company is exposed to market risks attributable to fluctuations in foreign currency exchange rates

primarily as the result of sourcing products priced in U.S. dollars and Hong Kong dollars while marketing and

selling those products in more than twenty currencies. Results of operations may be affected primarily by

changes in the value of the U.S. dollar, Hong Kong dollar, Euro, British pound sterling, Canadian dollar,

Brazilian real, Russian ruble and Mexican peso and, to a lesser extent, other currencies in Latin American and

Asia Pacific countries.

To manage this exposure, the Company has hedged a portion of its forecasted foreign currency transactions

using foreign exchange forward contracts. The Company estimates that a hypothetical immediate 10%

depreciation of the U.S. dollar against all foreign currencies included in these foreign exchange forward contracts

could result in an approximate $124.6 million decrease in the fair value of these instruments. A decrease in the

fair value of these instruments would be substantially offset by decreases in the value of the forecasted foreign

currency transactions.

The Company is also exposed to foreign currency risk with respect to its net cash and cash equivalents or

short-term borrowing positions in currencies other than the U.S. dollar. The Company believes, however, that the

on-going risk on the net exposure should not be material to its financial condition. In addition, the Company’s

revenues and costs have been and will likely continue to be affected by changes in foreign currency rates. A

significant change in foreign exchange rates can materially impact the Company’s revenues and earnings due to

translation of foreign-denominated revenues and expenses. The Company does not hedge against translation

impacts of foreign exchange. From time to time, affiliates of the Company may make or receive intercompany

loans in currencies other than their functional currency. The Company manages this exposure at the time the loan

is made by using foreign exchange contracts.

The Company reflects all derivatives at their fair value as an asset or liability on the consolidated balance

sheets. The Company does not speculate in foreign currency exchange contracts. At December 27, 2015, these

contracts had net unrealized gains of $106.4 million, of which $73.0 million are recorded in prepaid expenses and

other current assets, $34.7 million are recorded in other assets, ($1.1) million are recorded in accrued liabilities

and ($0.2) million are recorded to other liabilities. Included in accumulated other comprehensive earnings at

December 27, 2015 are deferred gains of $98.7 million, net of tax, related to these derivatives.

At December 27, 2015, the Company had fixed rate long-term debt of $1,559.9 million. Of this long-term

debt, $600.0 million represents the aggregate issuance of long-term debt in May 2014 which consists of $300.0

million of 3.15% Notes Due 2021 and $300.0 million of 5.10% Notes Due 2044. Prior to the May 2014 debt

issuance, the Company entered into forward-starting interest rate swap agreements with a total notional value of

$500.0 million to hedge the anticipated underlying U.S. Treasury interest rate. These interest rate swaps were

matched with this debt issuance and were designated and effective as hedges of the change in future interest

payments. At the date of issuance, the Company terminated these swap agreements and their fair value at the date

of issuance was recorded in accumulated other comprehensive loss and is being amortized through the

consolidated statements of operations using an effective interest rate method over the life of the related debt.

Included in accumulated other comprehensive loss at December 27, 2015 are deferred losses, net of tax, of $19.4

million related to these derivatives.

53