Hasbro 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

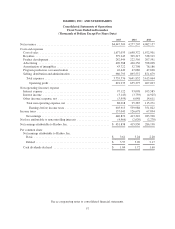

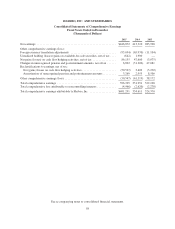

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Thousands of Dollars and Shares Except Per Share Data)

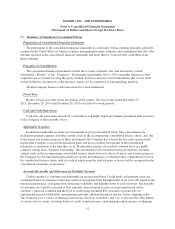

(1) Summary of Significant Accounting Policies

Preparation of Consolidated Financial Statements

The preparation of the consolidated financial statements in conformity with accounting principles generally

accepted in the United States of America requires management to make estimates and assumptions that affect the

amounts reported in the consolidated financial statements and notes thereto. Actual results could differ from

those estimates.

Principles of Consolidation

The consolidated financial statements include the accounts of Hasbro, Inc. and all majority-owned

subsidiaries (“Hasbro” or the “Company”). Investments representing 20% to 50% ownership interests in other

companies are accounted for using the equity method. For those majority-owned subsidiaries that are not 100%

owned by Hasbro, the interests of the minority owners are accounted for as noncontrolling interests.

All intercompany balances and transactions have been eliminated.

Fiscal Year

Hasbro’s fiscal year ends on the last Sunday in December. The fiscal years ended December 27,

2015, December 28, 2014 and December 29, 2013 were fifty-two week periods.

Cash and Cash Equivalents

Cash and cash equivalents include all cash balances and highly liquid investments purchased with a maturity

to the Company of three months or less.

Marketable Securities

Included in marketable securities are investments in private investment funds. These investments are

included in prepaid expenses and other current assets in the accompanying consolidated balance sheets, and, due

to the nature and business purpose of these investments, the Company has selected the fair value option which

requires the Company to record the unrealized gains and losses on these investments in the consolidated

statements of operations at the time they occur. Marketable securities also include common stock in a public

company arising from a business relationship. This investment is also included in prepaid expenses and other

current assets in the accompanying consolidated balance sheets; however, due to its nature and business purpose,

the Company records unrealized gains and losses on this investment in accumulated other comprehensive loss in

the consolidated balance sheets until it is sold at which point the realized gains or losses will be recognized in the

consolidated statements of operations.

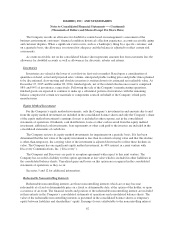

Accounts Receivable and Allowance for Doubtful Accounts

Credit is granted to customers predominantly on an unsecured basis. Credit limits and payment terms are

established based on extensive evaluations made on an ongoing basis throughout the fiscal year with regard to the

financial performance, cash generation, financing availability and liquidity status of each customer. The majority

of customers are formally reviewed at least annually; more frequent reviews are performed based on the

customer’s financial condition and the level of credit being extended. For customers on credit who are

experiencing financial difficulties, management performs additional financial analyses before shipping orders.

The Company uses a variety of financial transactions, based on availability and cost, to increase the collectability

of certain of its accounts, including letters of credit, credit insurance, and requiring cash in advance of shipping.

61