Hasbro 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 versus 2013

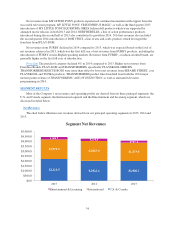

International segment operating profit increased 15% in 2014 compared to 2013. Operating profit for the

International segment in 2014 was impacted by approximately $18.8 million due to unfavorable foreign currency

translation. Furthermore, 2014 segment operating profit includes $6.1 million of restructuring charges. Operating

profit margin increased to 13.4% of segment net revenues in 2014 from 12.6% of segment net revenues in 2013.

The increase in operating profit in 2014 was the result of higher net revenues and favorable product mix, partially

offset by higher expense levels. The improvement in operating profit margin in 2014 is primarily due to both

revenue volume and mix, along with better expense leverage from higher net revenues.

Entertainment and Licensing

2015 versus 2014

Entertainment and Licensing segment operating profit increased 27% in 2015 compared to 2014 and

operating profit margin increased to 31.4% of net revenues in 2015 compared to 27.6% in 2014. Higher

entertainment revenues related to a multi-year digital distribution agreement contributed to improved operating

profit. Operating profit and operating profit margin also improved on lower amortization of intangibles and

program production cost amortization. Lower amortization of intangibles reflects certain digital gaming rights

which became fully amortized during the second quarter of 2015 whereas lower program product cost

amortization reflects a higher level of programming write downs occurring in the second half of 2014 compared

to 2015. These increases were partially offset by higher selling, distribution and administration expenses

reflecting investment in expanding the global footprint of the Company’s consumer products licensing teams.

2014 versus 2013

Entertainment and Licensing segment operating profit increased 33% in 2014 compared to 2013. The

increase in operating profit is primarily due to the profit impact from higher net revenues from consumer

products licensing, partially offset by the profit impact from lower entertainment revenues. Backflip operating

losses approximated $8.7 million in 2014 and were primarily due to amortization of acquired intangibles.

Other Segments and Corporate and eliminations

In the Global Operations segment, operating profit of $12.0 million in 2015 compared to $15.8 million in

2014 and $6.7 million in 2013.

In Corporate and eliminations, operating loss of $83.0 million in 2015 compared to operating losses of $46.1

million in 2014 and $134.3 million in 2013. The 2013 operating loss includes the following charges, $46.1

million — settlement of an adverse arbitration award and $40.6 million — other product-related charges. 2013

also includes certain charges related to the write-off of early film development costs associated with films that

had not yet been moved to production.

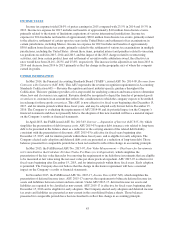

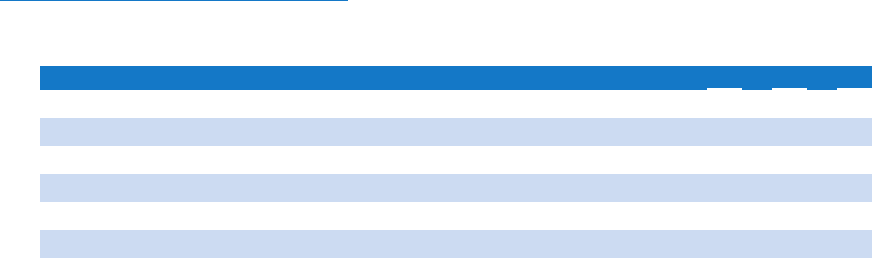

OPERATING COSTS AND EXPENSES

The Company’s operating expenses, stated as percentages of net revenues, are illustrated below for each

year in the three fiscal years ended December 27, 2015:

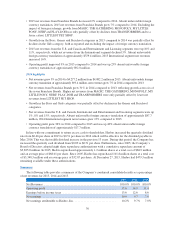

2015 2014 2013

Cost of sales ..................................................... 37.7% 39.7% 41.0%

Royalties ........................................................ 8.5 7.1 8.3

Product development .............................................. 5.5 5.2 5.1

Advertising ...................................................... 9.2 9.8 9.8

Amortization of intangibles ......................................... 1.0 1.2 1.9

Program production cost amortization ................................. 1.0 1.1 1.2

Selling, distribution and administration ................................ 21.6 20.9 21.3

38