Hasbro 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

The Company performs an annual impairment test on goodwill. This annual impairment test is performed in

the fourth quarter of the Company’s fiscal year. In addition, if an event occurs or circumstances change that

indicate that the carrying value may not be recoverable, the Company will perform an interim impairment test at

that time. For the three fiscal years ended December 27, 2015, no such events occurred. Entertainment and

Licensing goodwill includes $119,111 related to the Company’s 70% interest in Backflip Studios, LLC

(“Backflip”), a mobile game developer based in Boulder, Colorado. Should Backflip not achieve its profitability

and growth targets, including anticipated game releases in 2016, the carrying value of this reporting unit may

become impaired.

The Company completed its annual impairment tests of goodwill in the fourth quarters of 2015, 2014 and

2013 concluding that there was no impairment of its goodwill.

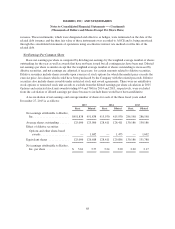

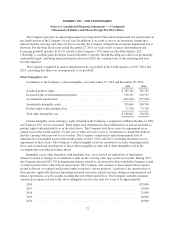

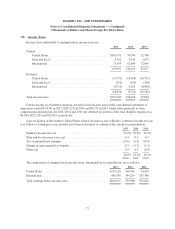

Other Intangibles, Net

A summary of the Company’s other intangibles, net at December 27, 2015 and December 28, 2014:

2015 2014

Acquired product rights .......................................... $789,781 789,781

Licensed rights of entertainment properties ........................... 256,555 256,555

Accumulated amortization ........................................ (841,267) (797,546)

Amortizable intangible assets ...................................... 205,069 248,790

Product rights with indefinite lives .................................. 75,738 75,738

Total other intangibles, net ........................................ $280,807 324,528

Certain intangible assets relating to rights obtained in the Company’s acquisition of Milton Bradley in 1984

and Tonka in 1991 are not amortized. These rights were determined to have indefinite lives and are included as

product rights with indefinite lives in the table above. The Company tests these assets for impairment on an

annual basis in the fourth quarters of each year or when an event occurs or circumstances change that indicate

that the carrying value may not be recoverable. The Company completed its annual impairment tests of

indefinite-lived intangible assets in the fourth quarter of 2015, 2014, and 2013 concluding that there was no

impairment of these assets. The Company’s other intangible assets are amortized over their remaining useful

lives, and accumulated amortization of these other intangibles is reflected in other intangibles, net in the

accompanying consolidated balance sheets.

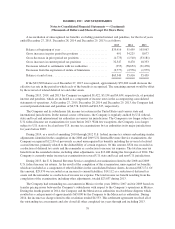

Intangible assets, other than those with indefinite lives, are reviewed for indications of impairment

whenever events or changes in circumstances indicate the carrying value may not be recoverable. During 2013,

the Company incurred $19,736 in impairment charges related to certain product lines which the Company exited

as well as product lines with reduced expectations. The Company will continue to incur amortization expense

related to the use of acquired and licensed rights to produce various products. A portion of the amortization of

these product rights will fluctuate depending on brand activation, related revenues during an annual period and

future expectations, as well as rights reaching the end of their useful lives. The Company currently estimates

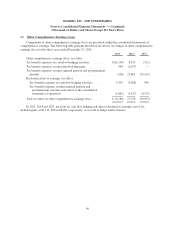

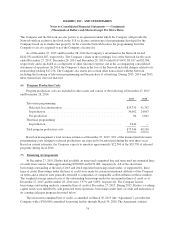

amortization expense related to the above intangible assets for the next five years to be approximately:

2016 ..................................................................... $35,000

2017 ..................................................................... 29,000

2018 ..................................................................... 21,000

2019 ..................................................................... 40,000

2020 ..................................................................... 40,000

72