Hasbro 2015 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

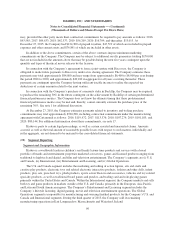

Principal international markets include Europe, Canada, Mexico and Latin America, Australia, and Hong

Kong.

Other Information

Hasbro markets its products primarily to customers in the retail sector. Although the Company closely

monitors the creditworthiness of its customers, adjusting credit policies and limits as deemed appropriate, a

substantial portion of its customers’ ability to discharge amounts owed is generally dependent upon the overall

retail economic environment.

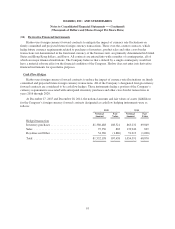

Sales to the Company’s three largest customers, Wal-Mart Stores, Inc., Toys “R” Us, Inc. and Target

Corporation, amounted to 16%, 9% and 9%, respectively, of consolidated net revenues during 2015, 16%, 9%

and 8%, respectively, of consolidated net revenues during 2014 and 16%, 10% and 9%, respectively, of

consolidated net revenues during 2013. These sales were primarily within the U.S. and Canada segment.

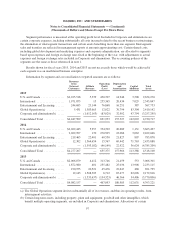

Hasbro purchases certain components used in its manufacturing process and certain finished products from

manufacturers in the Far East. The Company’s reliance on external sources of manufacturing can be shifted, over

a period of time, to alternative sources of supply for products it sells, should such changes be necessary.

However, if the Company were prevented from obtaining products from a substantial number of its current Far

East suppliers due to political, labor or other factors beyond its control, the Company’s operations would be

disrupted, potentially for a significant period of time, while alternative sources of product were secured. The

imposition of trade sanctions, quotas or other protectionist measures by the United States or the European Union

against a class of products imported by Hasbro from, or the loss of “normal trade relations” status with, China

could significantly increase the cost of the Company’s products imported into the United States or Europe.

The Company has agreements which allow it to develop and market products based on properties owned by

third parties including its license with Marvel Entertainment, LLC and Marvel Characters B.V. (together

“Marvel”) and its license with Lucas Licensing Ltd. and Lucasfilm Ltd. (together “Lucas”). These licenses have

multi-year terms and provide the Company with the right to market and sell designated classes of products based

on Marvel’s portfolio of brands, including SPIDER-MAN and THE AVENGERS, and Lucas’ STAR WARS

brand. Hasbro’s net revenues from these licenses can be significant in any given year based on the level of third

party entertainment. Both Marvel and Lucas are owned by The Walt Disney Company.

99