Hasbro 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

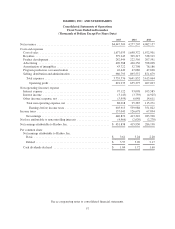

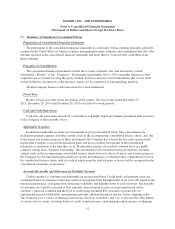

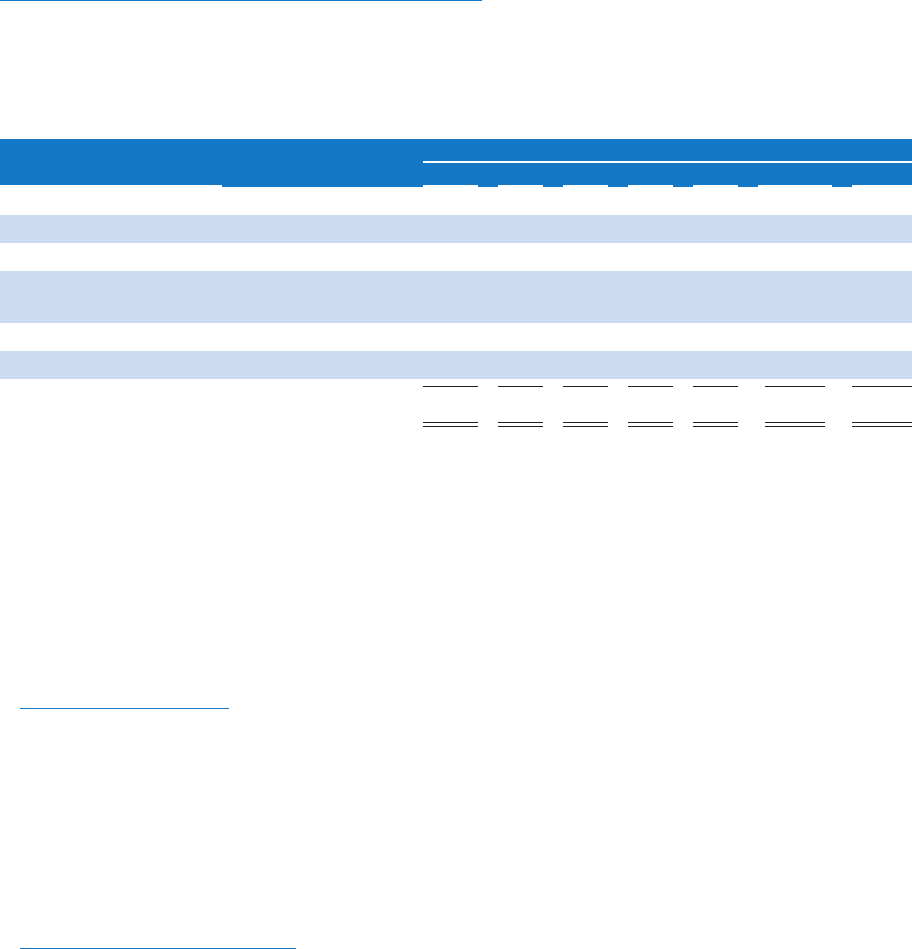

Contractual Obligations and Commercial Commitments

In the normal course of its business, the Company enters into contracts related to obtaining rights to produce

product under license, which may require the payment of minimum guarantees, as well as contracts related to the

leasing of facilities and equipment. In addition, the Company has $1,559.9 million in principal amount of long-

term debt outstanding at December 27, 2015. Future payments required under these and other obligations as of

December 27, 2015 are as follows:

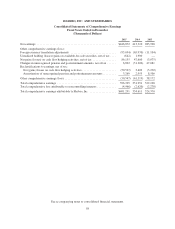

Payments due by Fiscal Year

Certain Contractual Obligations 2016 2017 2018 2019 2020 Thereafter Total

Long-term debt ........................... $ — 350.0———1,209.9 1,559.9

Interest payments on long-term debt ........... 85.8 85.8 63.8 63.8 63.8 1,041.4 1,404.4

Operating lease commitments ................ 32.8 26.7 24.3 21.6 12.9 15.5 133.8

Future minimum guaranteed contractual royalty

payments .............................. 43.6 64.6 62.3 56.2 16.7 13.0 256.4

Tax sharing agreementa..................... 6.4 6.7 7.0 7.6 8.0 49.1 84.8

Purchase commitmentsb..................... 518.5 113.4 107.3 101.2 80.1 — 920.5

$687.1 647.2 264.7 250.4 181.5 2,328.9 4,359.8

aIn connection with the Company’s agreement to form a joint venture with Discovery, the Company is

obligated to make future payments to Discovery under a tax sharing agreement. These payments are

contingent upon the Company having sufficient taxable income to realize the expected tax deductions of

certain amounts related to the joint venture. Accordingly, estimates of these amounts are included in the table

above.

bPurchase commitments represent agreements (including open purchase orders) to purchase inventory and

tooling in the ordinary course of business as well as purchase commitments under a manufacturing

agreement. The reported amounts exclude inventory and tooling purchase liabilities included in accounts

payable or accrued liabilities on the consolidated balance sheets as of December 27, 2015.

Theatrical Contingencies

The table above excludes up to $70.0 million in guaranteed royalties related to the Company’s license

agreement related to MARVEL as such amounts are contingent on the quantity and type of theatrical movie

releases and may be payable during the next six years. The Company expects to pay approximately $40.0 million

of these additional royalties in 2016 based on expected qualifying theatrical releases.

The table above also excludes $100.0 million in guaranteed royalties related to the Company’s license

agreement related to STAR WARS as the amount and timing of such payments are due in accordance with the

anticipated releases of new STAR WARS theatrical releases in 2017 and beyond.

Other Expected Future Payments

From time to time, the Company may be party to arrangements, contractual or otherwise, whereby the

Company may not be able to estimate the ultimate timing or amount of the related payments. As such, these

amounts have been excluded from the table above and described below.

• The Company holds a 70% stake in Backflip and may be required to purchase the remaining 30% in the

future contingent on the achievement by Backflip of certain predetermined financial performance metrics.

The Company does not know the ultimate timing of when these predetermined financial performance

metrics may be met and, therefore, cannot currently estimate the purchase price of the remaining 30%.

• Included in other liabilities in the consolidated balance sheets at December 27, 2015, the Company has a

liability of $68.3 million of potential tax, interest and penalties for uncertain tax positions that have been

taken or are expected to be taken in various income tax returns. The Company does not know the ultimate

52