Hasbro 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

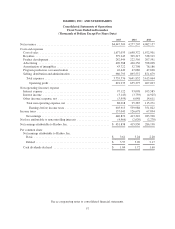

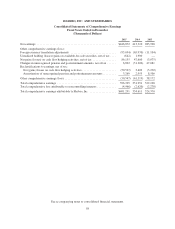

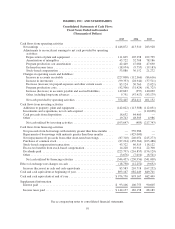

HASBRO, INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

Fiscal Years Ended in December

(Thousands of Dollars)

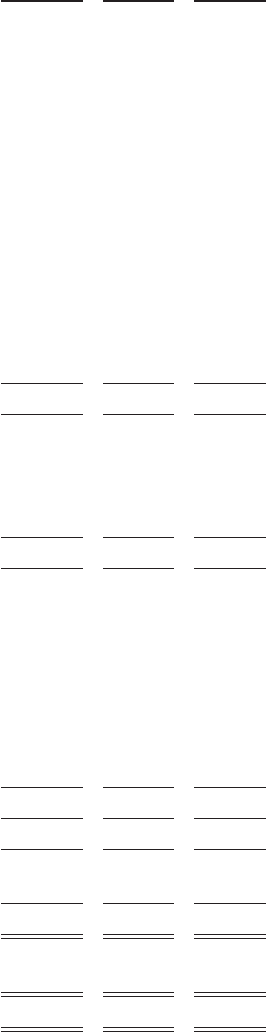

2015 2014 2013

Cash flows from operating activities

Net earnings .................................................. $446,872 413,310 283,928

Adjustments to reconcile net earnings to net cash provided by operating

activities:

Depreciation of plant and equipment ............................. 111,605 105,258 102,799

Amortization of intangibles .................................... 43,722 52,708 78,186

Program production cost amortization ............................ 42,449 47,086 47,690

Deferred income taxes ........................................ (18,954) (9,755) (19,183)

Stock-based compensation ..................................... 53,880 36,152 21,272

Changes in operating assets and liabilities:

Increase in accounts receivable ................................. (227,808) (112,366) (86,616)

Increase in inventories ........................................ (99,353) (28,944) (37,511)

Decrease (increase) in prepaid expenses and other current assets ....... 83,124 30,760 (5,021)

Program production costs ...................................... (42,506) (31,424) (41,325)

Increase (decrease) in accounts payable and accrued liabilities ........ 149,663 (957) 140,092

Other, including long-term advances ............................. 9,751 (47,417) (83,179)

Net cash provided by operating activities ......................... 552,445 454,411 401,132

Cash flows from investing activities

Additions to property, plant and equipment .......................... (142,022) (113,388) (112,031)

Investments and acquisitions, net of cash acquired .................... — — (110,698)

Cash proceeds from dispositions .................................. 18,632 64,400 —

Other ........................................................ 19,743 48,503 4,986

Net cash utilized by investing activities ........................... (103,647) (485) (217,743)

Cash flows from financing activities

Net proceeds from borrowings with maturity greater than three months . . . — 559,986 —

Repayments of borrowings with maturity greater than three months ...... — (425,000) —

Net (repayments of) proceeds from other short-term borrowings ......... (87,310) 246,054 (215,273)

Purchases of common stock ...................................... (87,224) (459,564) (103,488)

Stock-based compensation transactions ............................. 43,322 60,519 118,122

Excess tax benefits from stock-based compensation ................... 14,228 10,914 22,300

Dividends paid ................................................ (225,797) (216,855) (156,129)

Other ........................................................ (3,676) (7,010) (6,541)

Net cash utilized by financing activities .......................... (346,457) (230,956) (341,009)

Effect of exchange rate changes on cash .............................. (18,758) (12,252) (9,632)

Increase (decrease) in cash and cash equivalents ...................... 83,583 210,718 (167,252)

Cash and cash equivalents at beginning of year ......................... 893,167 682,449 849,701

Cash and cash equivalents at end of year .............................. $976,750 893,167 682,449

Supplemental information

Interest paid .................................................. $ 93,106 106,755 90,605

Income taxes paid .............................................. $144,137 182,158 88,189

See accompanying notes to consolidated financial statements.

59