Hasbro 2015 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2015 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

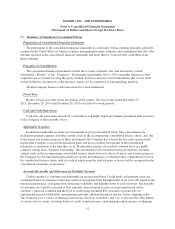

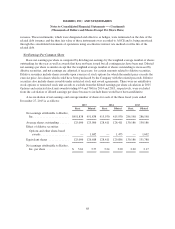

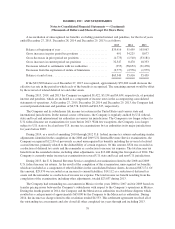

(2) Other Comprehensive Earnings (Loss)

Components of other comprehensive earnings (loss) are presented within the consolidated statements of

comprehensive earnings. The following table presents the related tax effects on changes in other comprehensive

earnings (loss) for the three years ended December 27, 2015.

2015 2014 2013

Other comprehensive earnings (loss), tax effect:

Tax benefit (expense) on cash flow hedging activities ............ $(11,190) 8,259 (511)

Tax benefit (expense) on unrealized holding gains ............... 364 (1,077) —

Tax benefit (expense) on unrecognized pension and postretirement

amounts .............................................. (928) 23,869 (25,193)

Reclassifications to earnings, tax effect:

Tax (benefit) expense on cash flow hedging activities .......... 5,435 (2,488) 946

Tax (benefit) expense on unrecognized pension and

postretirement amounts reclassified to the consolidated

statements of operations ............................... (1,861) (1,327) (4,275)

Total tax effect on other comprehensive earnings (loss) ........... $ (8,180) 27,236 (29,033)

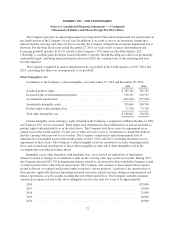

In 2015, 2014 and 2013, net gains on cash flow hedging activities reclassified to earnings, net of tax,

included gains of $1,111, $58 and $168, respectively, as a result of hedge ineffectiveness.

69