Hasbro 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

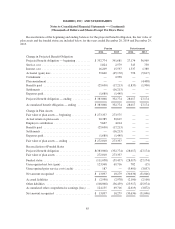

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

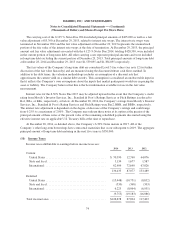

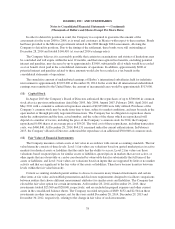

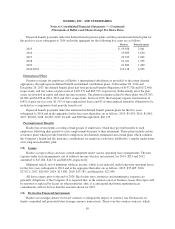

respective director ceases to be a member of the Company’s Board of Directors. These awards were valued at the

market value of the underlying common stock at the date of grant and vested upon grant. In connection with

these grants, compensation cost of $1,834 was recorded in selling, distribution and administration expense in the

year ended December 28, 2014 and $1,560 in each year in the two-year period ended December 29, 2013.

Cash-Settled Restricted Stock Units

In 2011 and 2010, the Company granted awards to certain employees consisting of cash settled restricted

stock units. Under these awards, the recipients are granted restricted stock units that vest over three years. At the

end of the vesting period, the fair value of those units based on Hasbro’s stock price will be paid in cash to the

recipient. The Company accounted for these awards as a liability which was marked to market through the

consolidated statements of operations based on the current market price and lapsed portion of the vesting period.

In 2014, 2013 and 2012, the Company recognized expense of $(113), $1,316 and $1,348, respectively related to

these awards.

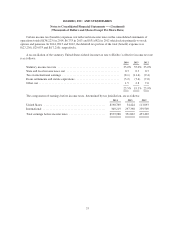

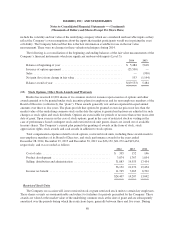

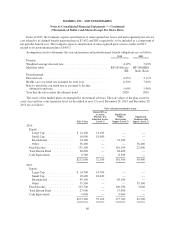

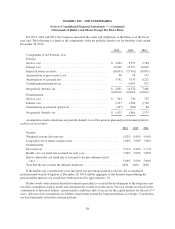

(14) Pension, Postretirement and Postemployment Benefits

Pension and Postretirement Benefits

The Company recognizes an asset or liability for each of its defined benefit pension plans equal to the

difference between the projected benefit obligation of the plan and the fair value of the plan’s assets. Actuarial

gains and losses and prior service costs that have not yet been included in income are recognized in the

consolidated balance sheets in AOCE. Reclassifications to earnings from AOCE related to pension and

postretirement plans are recorded to selling, distribution and administration expense.

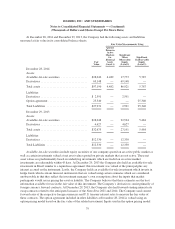

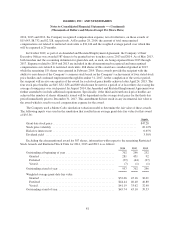

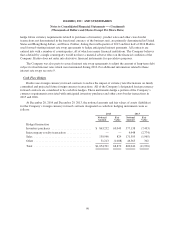

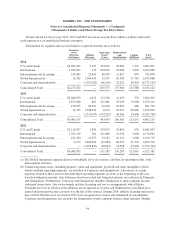

Expenses related to the Company’s defined benefit pension and defined contribution plans for 2014, 2013

and 2012 were approximately $34,300, $35,900 and $40,300, respectively. Of these amounts, $28,100, $23,000

and $29,500, respectively, related to defined contribution plans in the United States and certain international

subsidiaries. The remainder of the expense relates to defined benefit pension plans discussed below.

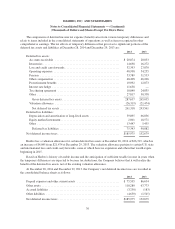

United States Plans

Prior to 2008, substantially all United States employees were covered under at least one of several non-

contributory defined benefit pension plans maintained by the Company. Benefits under the two major plans

which principally cover non-union employees, were based primarily on salary and years of service. One of these

major plans is funded. Benefits under the remaining plans are based primarily on fixed amounts for specified

years of service. Of these remaining plans, the plan covering union employees is also funded. In 2007, for the

two major plans covering its non-union employees, the Company froze benefits being accrued effective at the

end of December 2007.

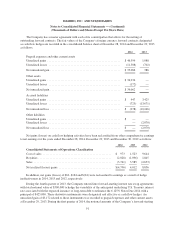

At December 28, 2014, the measurement date, the projected benefit obligations of the funded plans were in

excess of the fair value of the plans’ assets in the amount of $73,398 while the unfunded plans of the Company

had an aggregate accumulated and projected benefit obligation of $37,660. At December 29, 2013 the projected

benefit obligations of the funded plans were in excess of the fair value of the plans’ assets in the amount of

$24,551 while the unfunded plans of the Company had an aggregate accumulated and projected benefit

obligation of $34,886.

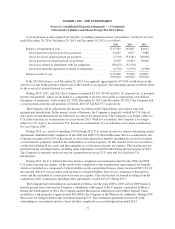

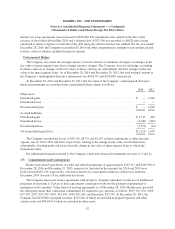

Hasbro also provides certain postretirement health care and life insurance benefits to eligible employees

who retire and have either attained age 65 with 5 years of service or age 55 with 10 years of service. The cost of

providing these benefits on behalf of employees who retired prior to 1993 is and will continue to be substantially

borne by the Company. The cost of providing benefits on behalf of substantially all employees who retire after

1992 is borne by the employee. The plan is not funded.

84