Hasbro 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

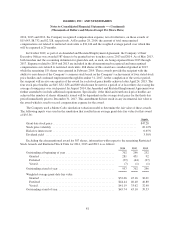

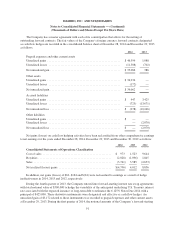

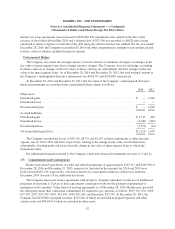

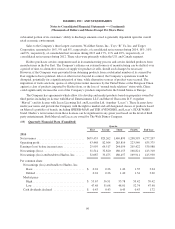

The Company has a master agreement with each of its counterparties that allows for the netting of

outstanding forward contracts. The fair values of the Company’s foreign currency forward contracts designated

as cash flow hedges are recorded in the consolidated balance sheet at December 28, 2014 and December 29, 2013

as follows:

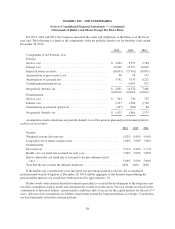

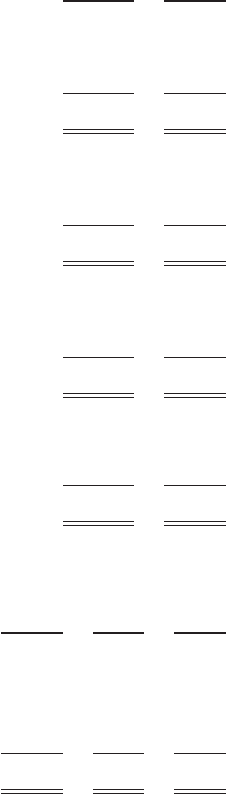

2014 2013

Prepaid expenses and other current assets

Unrealized gains .................................................. $46,594 1,088

Unrealized losses ................................................. (11,508) (702)

Net unrealized gain ................................................ $35,086 386

Other assets

Unrealized gains .................................................. $34,234 —

Unrealized losses ................................................. (172) —

Net unrealized gain ................................................ $34,062 —

Accrued liabilities

Unrealized gains .................................................. $ 447 3,425

Unrealized losses ................................................. (725) (13,671)

Net unrealized loss ................................................ $ (278) (10,246)

Other liabilities

Unrealized gains .................................................. $ — —

Unrealized losses ................................................. — (2,070)

Net unrealized loss ................................................ $ — (2,070)

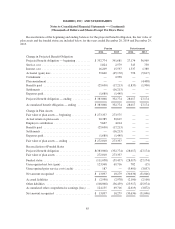

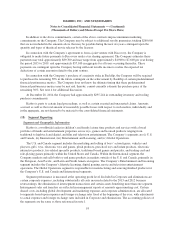

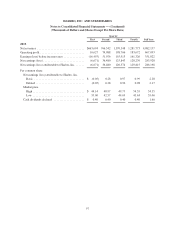

Net gains (losses) on cash flow hedging activities have been reclassified from other comprehensive earnings

to net earnings for the years ended December 28, 2014, December 29, 2013 and December 30, 2012 as follows:

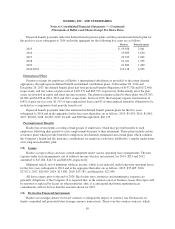

2014 2013 2012

Consolidated Statements of Operations Classification

Cost of sales ............................................... $ 973 1,523 9,644

Royalties .................................................. (2,028) (1,096) 1,845

Sales ..................................................... (3,741) 3,585 (2,633)

Net realized (losses) gains .................................... $(4,796) 4,012 8,856

In addition, net gains (losses) of $62, $164 and $(94) were reclassified to earnings as a result of hedge

ineffectiveness in 2014, 2013 and 2012, respectively.

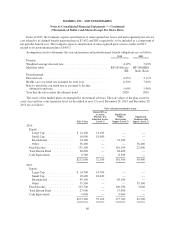

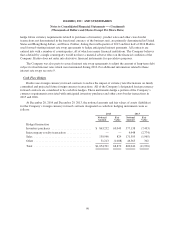

During the fourth quarter of 2013, the Company entered into forward-starting interest rate swap agreements

with total notional value of $300,000 to hedge the variability of the anticipated underlying U.S. Treasury interest

rate associated with the expected issuance of long-term debt to refinance the 6.125% Notes Due 2014 with a

principal of $425,000. These derivative instruments were designated and effective as cash flow hedges. An

unrealized gain of $3,172 related to these instruments was recorded to prepaid expenses and other current assets

at December 29, 2013. During the first quarter of 2014, the notional amounts of the Company’s forward-starting

91