Hasbro 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

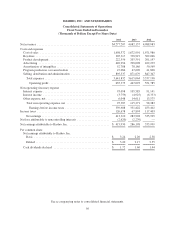

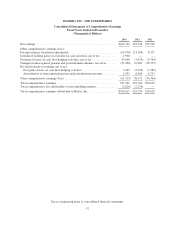

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

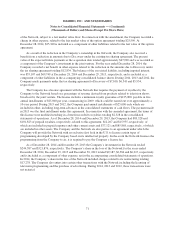

The Company produces television programming for license to third parties. Revenues from the licensing of

television programming are recorded when the content is available for telecast by the licensee and when certain

other conditions are met.

Revenue from product sales less related provisions for discounts, rebates and returns, as well as royalty

revenues and television programming revenues comprise net revenues in the consolidated statements of

operations.

Costs of Sales

Cost of sales primarily consists of purchased materials, labor, tooling, manufacturing overheads and other

inventory-related costs, such as obsolescence.

Royalties

The Company enters into license agreements with inventors, designers and others for the use of intellectual

properties in its products. These agreements may call for payment in advance or future payment of minimum

guaranteed amounts. Amounts paid in advance are recorded as an asset and charged to expense as revenue from

the related products is recognized. If all or a portion of the minimum guaranteed amounts appear not to be

recoverable through future use of the rights obtained under license, the non-recoverable portion of the guaranty is

charged to expense at that time.

Advertising

Production costs of commercials are expensed in the fiscal year during which the production is first aired.

The costs of other advertising and promotion programs are expensed in the fiscal year incurred.

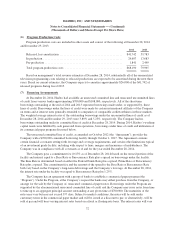

Program Production Costs

The Company incurs costs in connection with the production of television programming. These costs are

capitalized by the Company as they are incurred and amortized using the individual-film-forecast method,

whereby these costs are amortized in the proportion that the current year’s revenues bear to management’s

estimate of total ultimate revenues as of the beginning of such period related to the program. These capitalized

costs are reported at the lower of cost, less accumulated amortization, or fair value, and reviewed for impairment

when an event or change in circumstances occurs that indicates that impairment may exist. The fair value is

determined using a discounted cash flow model which is primarily based on management’s future revenue and

cost estimates.

Shipping and Handling

Hasbro expenses costs related to the shipment and handling of goods to customers as incurred. For 2014,

2013 and 2012, these costs were $157,326, $155,316 and $157,035, respectively, and are included in selling,

distribution and administration expenses.

Operating Leases

Hasbro records lease expense on a straight-line basis inclusive of rent concessions and increases.

Reimbursements from lessors for leasehold improvements are deferred and recognized as a reduction to lease

expense over the remaining lease term.

Income Taxes

Hasbro uses the asset and liability approach for financial accounting and reporting of income

taxes. Deferred income taxes reflect the net tax effect of temporary differences between the carrying amount of

63