Hasbro 2014 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2014 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

Stock Performance Awards

In 2014, 2013 and 2012, as part of its annual equity grant to executive officers and certain other employees,

the Company issued contingent stock performance awards (the “Stock Performance Awards”). These awards

provide the recipients with the ability to earn shares of the Company’s common stock based on the Company’s

achievement of stated cumulative diluted earnings per share and cumulative net revenue targets over the three

fiscal years ended December 2016, December 2015, and December 2014 for the 2014, 2013 and 2012 awards,

respectively. Each Stock Performance Award has a target number of shares of common stock associated with

such award which may be earned by the recipient if the Company achieves the stated diluted earnings per share

and revenue targets. The ultimate amount of the award may vary, depending on actual results. Awards may vary

from 0% to 200% of the target number of shares.

In October 2012, as part of the Amended and Restated Employment Agreement with the Company’s Chief

Executive Officer, the stock performance awards for the Chief Executive Officer for 2014 and 2013 could be

adjusted at the time of vesting dependent on the Company’s total shareholder return compared to the Standard &

Poor’s 500 return for the applicable performance period. As part of the amendment to this agreement in August

2014, this adjustment was eliminated. The fair value of the award used to record compensation expense was not

impacted by this amendment.

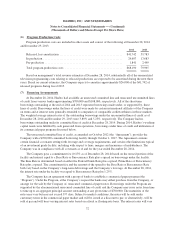

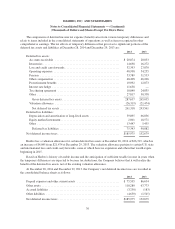

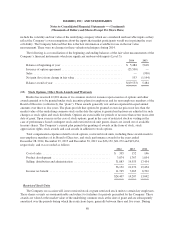

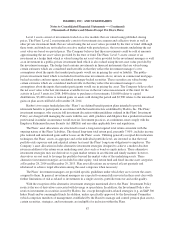

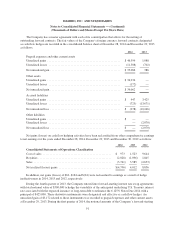

Information with respect to Stock Performance Awards for 2014, 2013 and 2012 is as follows:

2014 2013 2012

Outstanding at beginning of year ................................. 943 1,019 1,627

Granted ................................................... 322 358 695

Forfeited .................................................. (32) (101) (144)

Cancelled ................................................. (578) (333) (682)

Vested .................................................... — — (477)

Outstanding at end of year ...................................... 655 943 1,019

Weighted average grant-date fair value:

Granted ................................................... $52.11 47.21 36.14

Forfeited .................................................. $43.21 40.24 37.54

Cancelled ................................................. $36.14 45.66 33.76

Vested .................................................... $ — — 22.31

Outstanding at end of year ...................................... $49.57 40.24 39.57

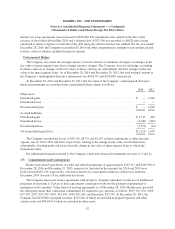

Shares cancelled in 2014, 2013 and 2012 represent the cancellation of the Stock Performance Awards

granted during 2012, 2011 and 2010, respectively, based on failure to meet the targets set forth by the agreement.

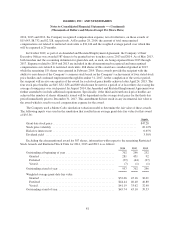

During 2014, 2013 and 2012, the Company recognized $11,315, $815 and $3,628, respectively, of expense

relating to these awards. Awards are valued at the market value of the underlying common stock at the dates of

grant and are expensed over the performance period. On a periodic basis the Company reviews the actual and

forecasted performance of the Company against the stated targets for each award. The total expense is adjusted

upward or downward based on the expected amount of shares to be issued as defined in the agreement. If

minimum targets as detailed under the award are not met, no additional compensation expense will be recognized

and any previously recognized compensation expense will be reversed. In the fourth quarter of 2013, it was

determined that it was no longer probable that the minimum targets would be met for certain Stock Performance

Awards grants and, as a result, all previously recognized expense totaling $7,046 related to these awards was

reversed. At December 28, 2014, the amount of total unrecognized compensation cost related to these awards is

approximately $18,310 and the weighted average period over which this will be expensed is 20 months.

82