Hasbro 2014 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2014 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and our partner brand SESAME STREET. In

Preschool, we are focused on Hasbro Franchise

Brands and story-led initiatives where we believe

we can dierentiate our oerings and deliver higher

profitability. While revenue has declined, today’s

revenue commands a higher margin, and our

Preschool category profitability is growing.

Storytelling

As evidenced by the success of MY LITTLE PONY,

TRANSFORMERS and MARVEL properties, it is clear

that stories are dierentiating brands, and industry

data supports this trend.

At Hasbro, we are using great stories and

great characters to drive innovation in all we

do. Entertainment and storytelling are integral

components of every brand. We invest in

entertainment across platforms, including digital

shorts, television, home entertainment and feature

films. Stories can be also be told through a mobile

game, on a tablet or online, or woven through

social media.

Hasbro Studios is developing much of this global

content for Hasbro brands. To date, the studio has

green-lit more than 1,250 half hours of original

programming, including hit and award-winning series

based on Hasbro brands, such as MY LITTLE PONY,

TRANSFORMERS and LITTLEST PET SHOP. These

programs air on networks around the world, on

streaming services and in home entertainment. Since

forming the studio, we have spent more than $260

million in cash to develop programming, which in turn

has delivered more than $1 billion in television-backed

merchandise sales.

To further the reach and impact of our content,

in 2014 we unveiled our new film label, ALLSPARK

PICTURES. ALLSPARK is an evolutionary step in

our entertainment strategy that allows us greater

control of the film-making process and increased

opportunities to reach multiple audiences.

We will continue to work with major film studio

partners on larger-budget films, including both the

TRANSFORMERS and G.I. JOE movie franchises, but

will create more modestly budgeted films through

ALLSPARK PICTURES, where and when it makes

economic sense.

In October 2015, our first film under the

ALLSPARK PICTURES label, JEM AND THE

HOLOGRAMS, will be released in partnership

with Universal Pictures. The film will introduce the

1980s pop star and her band to a new generation

of girls. In JEM AND THE HOLOGRAMS, four

aspiring musicians will take the world by storm

when they see that the key to creating one’s

own destiny lies in finding one’s own voice.

In addition, with the global success of MY LITTLE

PONY, we believe this is the right time to bring the

story of our “mane” cast to the big screen. We are

currently developing a MY LITTLE PONY feature film

under the ALLSPARK banner for release in the 2017

timeframe. This project is just underway, and we look

forward to updating you on our progress in future

communications.

Brand-Driven Consumer Engagement

While stories further the reach of our brands, they

also fuel our consumers’ desire to experience brands

across a broad spectrum of licensed consumer

products. Over the past several years, we built our

global licensing organization and developed our

storytelling capacity to capitalize on this opportunity.

Our Hasbro-owned brands give us access to

profitable incremental revenue opportunities in

licensing, entertainment and digital gaming. Through

the execution of our brands across the blueprint,

we have dramatically expanded the revenue and

profit opportunities of these properties. A few select

brands, including MONOPOLY and MY LITTLE PONY,

are capitalizing on their cultural relevance and broad

appeal, delivering a higher percentage of total

revenues in the licensing category.

ANNUAL REPORT

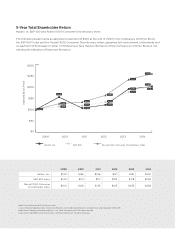

From 2012 to 2014, entertainment-based

toy revenues in the U.S. grew at a 7%

compound annual growth rate, while non-

entertainment toys remained essentially flat.3