Hasbro 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

based on market conditions and the ratings assigned to the notes by the credit rating agencies at the time of

issuance. At December 28, 2014, the Company had notes outstanding under the Program of $239,976 with a

weighted average interest rate of 0.44%. There were no notes outstanding under the Program at December 29,

2013.

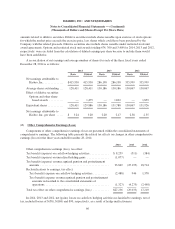

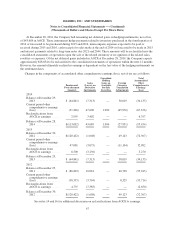

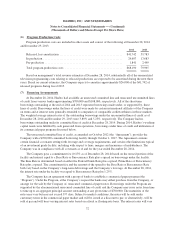

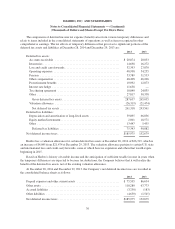

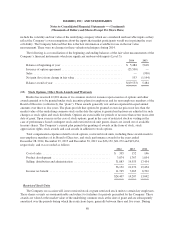

(8) Accrued Liabilities

Components of accrued liabilities are as follows:

2014 2013

Royalties ....................................................... $ 83,217 168,950

Advertising ..................................................... 78,530 84,815

Payroll and management incentives .................................. 82,774 73,970

Other .......................................................... 365,383 400,024

Total accrued liabilities ............................................ $609,904 727,759

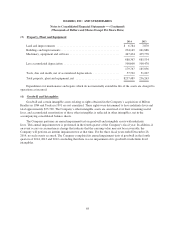

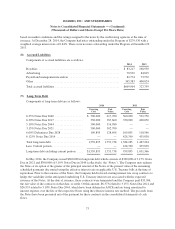

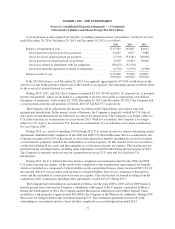

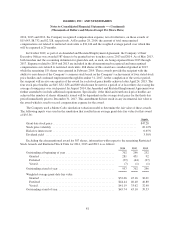

(9) Long-Term Debt

Components of long-term debt are as follows:

2014 2013

Carrying

Cost

Fair

Value

Carrying

Cost

Fair

Value

6.35% Notes Due 2040 ................... $ 500,000 617,700 500,000 532,750

6.30% Notes Due 2017 ................... 350,000 387,660 350,000 400,050

5.10% Notes Due 2044 ................... 300,000 316,980 — —

3.15% Notes Due 2021 ................... 300,000 302,700 — —

6.60% Debentures Due 2028 ............... 109,895 128,698 109,895 118,566

6.125% Notes Due 2014 .................. — — 428,390 435,838

Total long-term debt ..................... 1,559,895 1,753,738 1,388,285 1,487,204

Less: Current portion ..................... — — 428,390 435,838

Long-term debt excluding current portion .... $1,559,895 1,753,738 959,895 1,051,366

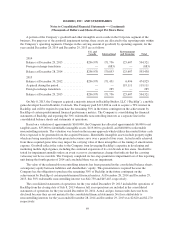

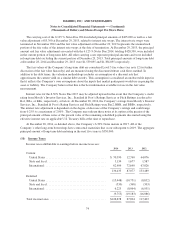

In May 2014, the Company issued $600,000 in long-term debt which consists of $300,000 of 3.15% Notes

Due in 2021 and $300,000 of 5.10% Notes Due in 2044 (collectively, the “Notes”). The Company may redeem

the Notes at its option at the greater of the principal amount of the Notes or the present value of the remaining

scheduled payments discounted using the effective interest rate on applicable U.S. Treasury bills at the time of

repurchase. Prior to the issuance of the Notes, the Company held forward-starting interest rate swap contracts to

hedge the variability in the anticipated underlying U.S. Treasury interest rate associated with the expected

issuance of the Notes. At the date of issuance, these contracts were terminated and the Company paid $33,306,

the fair value of the contracts on that date, to settle. Of this amount, $6,373 related to 3.15% Notes Due 2021 and

$26,933 related to 5.10% Notes Due 2044, which have been deferred in AOCE and are being amortized to

interest expense over the life of the respective Notes using the effective interest rate method. The proceeds from

the Notes have been presented net of the payment for these contracts in the consolidated statements of cash

flows.

73