Hasbro 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In Corporate and Eliminations, operating losses totaled $46,149 in 2014, $134,323 in 2013 and $20,003 in

2012. Corporate and Eliminations includes restructuring and related pension charges of $41,973 for the year

ended December 29, 2013 and restructuring charges (benefit) of $(3,297) and $38,242 for the years ended

December 28, 2014 and December 30, 2012, respectively. The Corporate and Eliminations operating loss during

the year ended December 29, 2013 also included charges of $46,050 related to the settlement of an adverse

arbitration award and $40,587 in other product-related charges. Lastly, the 2013 operating loss also includes a

charge related to the write-off of early film development costs associated with films that had not yet moved to

production.

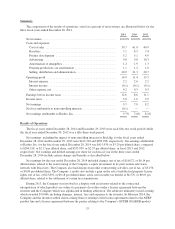

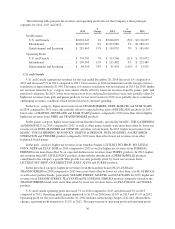

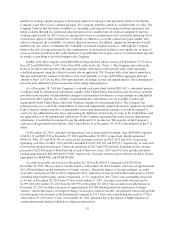

Operating Expenses

The Company’s operating expenses, stated as percentages of net revenues, are illustrated below for the three

fiscal years ended December 28, 2014:

2014 2013 2012

Cost of sales ..................................................... 39.7% 41.0% 40.9%

Royalties ........................................................ 7.1 8.3 7.4

Product development .............................................. 5.2 5.1 4.9

Advertising ...................................................... 9.8 9.8 10.3

Amortization of intangibles ......................................... 1.2 1.9 1.3

Program production cost amortization ................................. 1.1 1.2 1.0

Selling, distribution and administration ................................ 20.9 21.3 20.7

Operating expenses for 2014, 2013 and 2012 include (benefits) expenses related to the following events:

• In September 2014, the Company and Discovery amended their relationship with respect to the Network.

Prior to the amendment, the Company had a license agreement with the Network that required payment of

royalties by the Company to the Network based on a percentage of revenue derived from products related

to television shows broadcast on the Network. This agreement included a minimum royalty guarantee of

$125,000, which has been paid in full. As part of the amended relationship, this earn-out period was

extended to 2021 resulting in a benefit of $2,328 to royalties for the year ended December 28,

2014. Furthermore, this amended relationship resulted in an amendment to the Company’s tax sharing

agreement with Discovery which resulted in a net expense of $870 recorded to selling, distribution and

administration expense for the year ended December 28, 2014.

• In February 2014, the Company settled outstanding disputes with an inventor related to the contractual

interpretation of which products were subject to payment of royalties under two license agreements

between the inventor and the Company relating to the Company’s NERF and SUPER SOAKER product

lines. As a result, the Company recorded a total charge of $61,140, of which $42,950 and $3,100 were

recorded to royalties and selling, distribution and administration expense, respectively, for the year ended

December 29, 2013. A portion of this total charge was also recorded to interest expense which is

discussed below.

• During the fourth quarter of 2012, the Company announced a multi-year cost savings initiative which

targets $100,000 in annual savings by the end of 2015, prior to other costs which have or are anticipated

to increase in 2014 as well as in future years. This initiative included an approximate 10% workforce

reduction, facility consolidations and process improvements. The Company recognized charges totaling

$5,224, $36,710 and $36,046 for the years ended December 28, 2014, December 29, 2013 and

December 30, 2012, respectively, primarily related to employee severance charges, which impacted cost

of sales, product development and selling, distribution and administration expenses. Furthermore, the

Company also recognized pension curtailment and settlement charges in the amount of $6,993 in selling,

distribution and administration expense during the year ended December 29, 2013.

39