Hasbro 2014 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2014 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

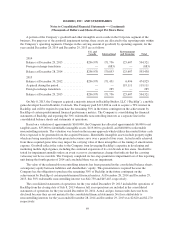

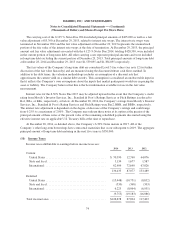

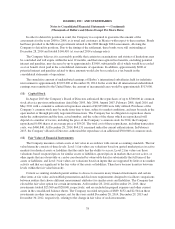

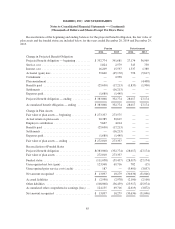

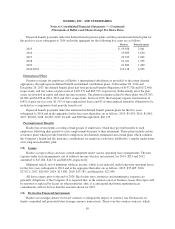

At December 28, 2014 and December 29, 2013, the Company had the following assets and liabilities

measured at fair value in its consolidated balance sheets:

Fair

Value

Fair Value Measurements Using

Quoted

Prices in

Active

Markets

for

Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

December 28, 2014

Assets:

Available-for-sale securities .................. $28,042 4,482 17,773 5,787

Derivatives ................................ 69,148 — 69,148 —

Total assets ................................ $97,190 4,482 86,921 5,787

Liabilities:

Derivatives ................................ $ 2,591 — 2,591 —

Option agreement ........................... 25,340 — — 25,340

Total Liabilities ............................ $27,931 — 2,591 25,340

December 29, 2013

Assets:

Available-for-sale securities .................. $28,048 — 22,564 5,484

Derivatives ................................ 4,627 — 4,627 —

Total assets ................................ $32,675 — 27,191 5,484

Liabilities:

Derivatives ................................ $12,330 — 12,330 —

Total Liabilities ............................ $12,330 — 12,330 —

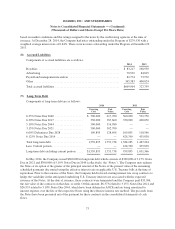

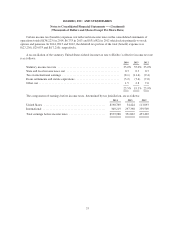

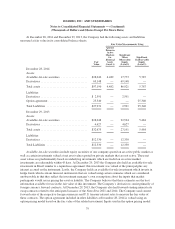

Available-for-sale securities include equity securities of one company quoted on an active public market as

well as certain investments valued at net asset values quoted on private markets that are not active. These net

asset values are predominantly based on underlying investments which are traded on an active market;

investments are redeemable within 45 days. At December 29, 2013 the Company also held an available-for-sale

investment in Brazil similar to a repurchase agreement; this investment was valued at the principal plus any

interest accrued on the instrument. Lastly, the Company holds an available-for-sale investment which invests in

hedge funds which contain financial instruments that are valued using certain estimates which are considered

unobservable in that they reflect the investment manager’s own assumptions about the inputs that market

participants would use in pricing the asset or liability. The Company believes that these estimates are the best

information available for use in the fair value of this investment. The Company’s derivatives consist primarily of

foreign currency forward contracts. At December 29, 2013, the Company also had forward-starting interest rate

swap contracts related to the anticipated issuance of the Notes Due 2021 and 2044. The Company used current

forward rates of the respective foreign currencies and U.S. treasury interest rates to measure the fair value of

these contracts. The option agreement included in other liabilities at December 28, 2014 is valued using an

option pricing model based on the fair value of the related investment. Inputs used in the option pricing model

79