Hasbro 2014 Annual Report Download - page 85

Download and view the complete annual report

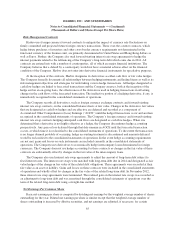

Please find page 85 of the 2014 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HASBRO, INC. AND SUBSIDIARIES

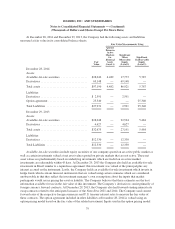

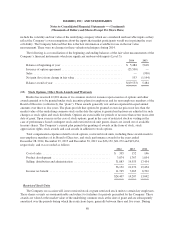

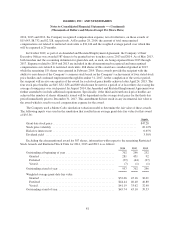

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

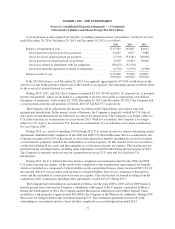

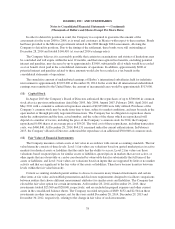

of the Network, subject to a fair market value floor. In connection with the amendment, the Company recorded a

charge in other expense, related to the fair market value of the option agreement totaling $25,590. At

December 28, 2014, $25,340 is included as a component of other liabilities related to the fair value of this option

agreement.

As a result of the reduction in the Company’s ownership in the Network, the Company also received a

benefit from a reduction in amounts due to Discovery under the existing tax sharing agreement. The present

value of the expected future payments at the acquisition date totaled approximately $67,900 and was recorded as

a component of the Company’s investment in the joint venture. For the year ended December 28, 2014, the

Company recorded a net benefit in other expense related to the reduction in the amounts due to Discovery under

the tax sharing agreement totaling $12,834. The balance of the associated liability, including imputed interest,

was $55,107 and $69,749 at December 28, 2014 and December 29, 2013, respectively, and is included as a

component of other liabilities in the accompanying consolidated balance sheets. During 2014, 2013 and 2012, the

Company made payments under the tax sharing agreement to Discovery of $7,010, $6,541 and $5,954,

respectively.

The Company has a license agreement with the Network that requires the payment of royalties by the

Company to the Network based on a percentage of revenue derived from products related to television shows

broadcast by the joint venture. The license includes a minimum royalty guarantee of $125,000, payable in five

annual installments of $25,000 per year, commencing in 2009, which could be earned out over approximately a

10-year period. During 2013 and 2012, the Company paid annual installments of $25,000 each which are

included in other, including long-term advances in the consolidated statements of cash flows. The payment made

in 2013 was the final installment under this agreement. In connection with the amended agreement, the terms of

this license were modified resulting in a benefit recorded to royalties totaling $2,328 in the consolidated

statements of operations. As of December 28, 2014 and December 29, 2013, the Company had $89,328 and

$101,823 of prepaid royalties, respectively, related to this agreement, $12,207 and $15,955, respectively, of

which are included in prepaid expenses and other current assets and $77,121 and $85,868, respectively, of which

are included in other assets. The Company and the Network are also parties to an agreement under which the

Company will provide the Network with an exclusive first look in the U.S. to license certain types of

programming developed by the Company based on its intellectual property. In the event the Network licenses the

programming from the Company to air, it is required to pay the Company a license fee.

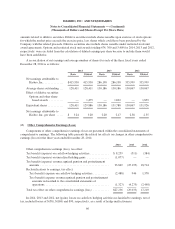

As of December 28, 2014 and December 29, 2013 the Company’s investment in the Network totaled

$244,587 and $321,876, respectively. The Company’s share in the loss of the Network for the years ended

December 28, 2014, December 29, 2013 and December 30, 2012 totaled $9,187, $2,386 and $6,015, respectively

and is included as a component of other expense, net in the accompanying consolidated statements of operations.

In 2014, the Company’s share in the loss of the Network included charges related to its restructuring totaling

$17,278. The Company also enters into certain other transactions with the Network including the licensing of

television programming and the purchase of advertising. During 2014, 2013 and 2012, these transactions were

not material.

71