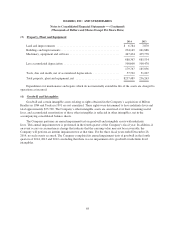

Hasbro 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

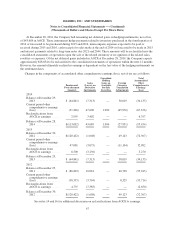

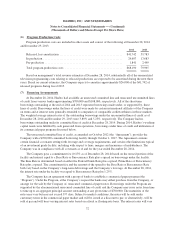

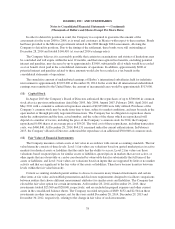

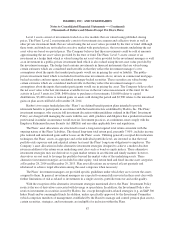

A reconciliation of unrecognized tax benefits, excluding potential interest and penalties, for the fiscal years

ended December 28, 2014, December 29, 2013 and December 30, 2012 is as follows:

2014 2013 2012

Balance at beginning of year ............................... $55,459 103,067 83,814

Gross increases in prior period tax positions ................ 34,225 8,677 3,089

Gross decreases in prior period tax positions ................ (1,510) (33,181) (10,856)

Gross increases in current period tax positions .............. 8,470 10,353 30,008

Decreases related to settlements with tax authorities .......... (58,652) (31,478) —

Decreases from the expiration of statute of limitations ........ (2,576) (1,979) (2,988)

Balance at end of year .................................... $35,416 55,459 103,067

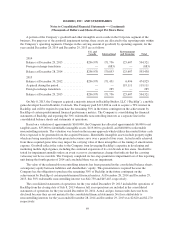

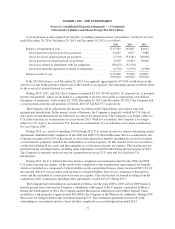

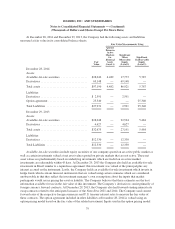

If the $35,416 balance as of December 28, 2014 is recognized, approximately $35,000 would decrease the

effective tax rate in the period in which each of the benefits is recognized. The remaining amount would be offset

by the reversal of related deferred tax assets.

During 2014, 2013, and 2012 the Company recognized $3,134, $4,634 and $3,110, respectively, of potential

interest and penalties, which are included as a component of income taxes in the accompanying consolidated

statements of operations. At December 28, 2014, December 29, 2013 and December 30, 2012, the Company had

accrued potential interest and penalties of $4,042, $24,547 and $20,377, respectively.

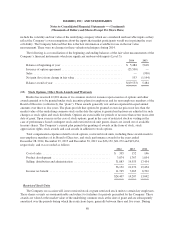

The Company and its subsidiaries file income tax returns in the United States and various state and

international jurisdictions. In the normal course of business, the Company is regularly audited by U.S. federal,

state and local and international tax authorities in various tax jurisdictions. The Company is no longer subject to

U.S. federal income tax examinations for years before 2013. With few exceptions, the Company is no longer

subject to U.S. state or local and non-U.S. income tax examinations by tax authorities in its major jurisdictions

for years before 2009.

During 2014, as a result of amending 2010 through 2012 U.S. federal income tax returns and making similar

adjustments identified in the completion of the 2008 and 2009 U.S. Internal Revenue Service examinations, the

Company recognized $12,159 of previously accrued unrecognized tax benefits including the reversal of related

accrued interest, primarily related to the deductibility of certain expenses. Of this amount, $324 was recorded as

a reduction of deferred tax assets and the remainder as a reduction to income tax expense. The total income tax

benefit from the amended returns, including other adjustments, totaled $13,480 during the first quarter of 2014.

The Company is currently under income tax examination in several U.S. state and local and non-U.S.

jurisdictions.

During 2013, the U.S. Internal Revenue Service completed an examination related to the 2008 and 2009

U.S. federal income tax returns. As the result of the completion of this examination, unrecognized tax benefits,

which are included as a component of other liabilities in the consolidated balance sheets, decreased $67,174. Of

this amount, $29,970 was recorded as an increase to current liabilities, $14,112 as a reduction of deferred tax

assets and the remainder as a reduction of income tax expense. The total income tax benefit resulting from the

completion of the examination, including other adjustments, totaled $23,637 during 2013.

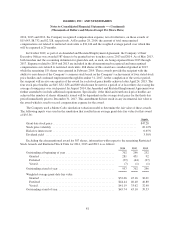

The Company had outstanding tax assessments in Mexico for the years 2000 to 2007 and for 2009 based on

transfer pricing issues between the Company’s subsidiaries with respect to the Company’s operations in Mexico.

During the fourth quarter of 2014, the Company and the Mexican tax authorities resolved these disputes which

resulted in a cash payment of approximately $65,000 by the Company to the Mexican tax authorities. During 2014,

the income tax charge related to this resolution totaled $4,533. This settlement agreement resolved all of the

outstanding tax assessments and also closed all other completed tax years through and included 2013.

77