Hasbro 2014 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2014 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

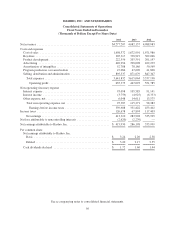

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

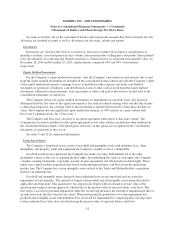

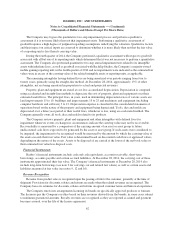

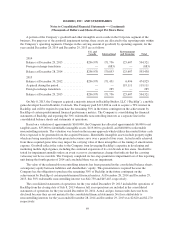

The Company may bypass the quantitative two-step impairment process and perform a qualitative

assessment if it is not more likely than not that impairment exists. Performing a qualitative assessment of

goodwill requires a high degree of judgment regarding assumptions underlying the valuation. Qualitative factors

and their impact on critical inputs are assessed to determine whether it is more likely than not that the fair value

of a reporting unit is less than its carrying value.

During the fourth quarter of 2014, the Company performed a qualitative assessment with respect to goodwill

associated with all but one of its reporting units which determined that it was not necessary to perform a quantitative

assessment. The Company also performed quantitative two-step annual impairment tests related to its intangible

assets with indefinite lives, as well as goodwill associated with Backflip Studios, the Company’s majority owned

mobile gaming reporting unit, in the fourth quarter of 2014 and no impairments were indicated as the estimated fair

values were in excess of the carrying value of the related intangible assets or reporting units, as applicable.

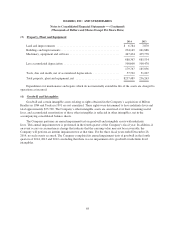

The remaining intangibles having defined lives are being amortized over periods ranging from four to

twenty years, primarily using the straight-line method. At December 28, 2014, approximately 13% of other

intangibles, net are being amortized in proportion to actual and projected revenues.

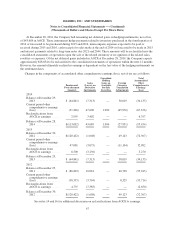

Property, plant and equipment are stated at cost less accumulated depreciation. Depreciation is computed

using accelerated and straight-line methods to depreciate the cost of property, plant and equipment over their

estimated useful lives. The principal lives, in years, used in determining depreciation rates of various assets are:

land improvements 15 to 19, buildings and improvements 15 to 25 and machinery and equipment (including

computer hardware and software) 3 to 12. Depreciation expense is classified in the consolidated statements of

operations based on the nature of the property and equipment being depreciated. Tools, dies and molds are

depreciated over a three-year period or their useful lives, whichever is less, using an accelerated method. The

Company generally owns all tools, dies and molds related to its products.

The Company reviews property, plant and equipment and other intangibles with defined lives for

impairment whenever events or changes in circumstances indicate the carrying value may not be recoverable.

Recoverability is measured by a comparison of the carrying amount of an asset or asset group to future

undiscounted cash flows expected to be generated by the asset or asset group. If such assets were considered to

be impaired, the impairment to be recognized would be measured by the amount by which the carrying value of

the assets exceeds their fair value. Fair value is determined based on discounted cash flows or appraised values,

depending on the nature of the assets. Assets to be disposed of are carried at the lower of the net book value or

their estimated fair value less disposal costs.

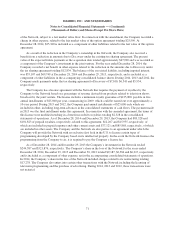

Financial Instruments

Hasbro’s financial instruments include cash and cash equivalents, accounts receivable, short-term

borrowings, accounts payable and certain accrued liabilities. At December 28, 2014, the carrying cost of these

instruments approximated their fair value. The Company’s financial instruments at December 28, 2014 also

include long-term borrowings (see note 9 for carrying cost and related fair values) as well as certain assets and

liabilities measured at fair value (see notes 9, 12 and 16).

Revenue Recognition

Revenue from product sales is recognized upon the passing of title to the customer, generally at the time of

shipment. Provisions for discounts, rebates and returns are made when the related revenues are recognized. The

Company bases its estimates for discounts, rebates and returns on agreed customer terms and historical experience.

The Company enters into arrangements licensing its brands on specifically approved products or formats.

The licensees pay the Company royalties based on their revenues derived from the brands, in some cases subject

to minimum guaranteed amounts. Royalty revenues are recognized as they are reported as earned and payment

becomes assured, over the life of the license agreement.

62