Hasbro 2014 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2014 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

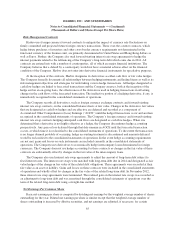

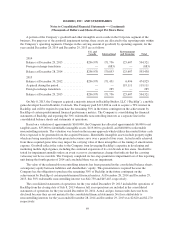

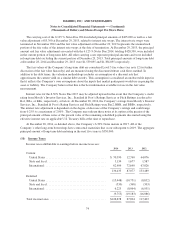

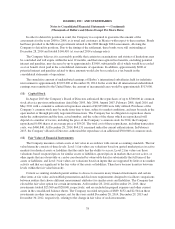

A summary of the Company’s other intangibles, net at December 28, 2014 and December 29, 2013:

2014 2013

Acquired product rights .......................................... $789,781 788,544

Licensed rights of entertainment properties ........................... 256,555 256,555

Accumulated amortization ........................................ (797,546) (744,838)

Amortizable intangible assets ...................................... 248,790 300,261

Product rights with indefinite lives .................................. 75,738 75,738

Total other intangibles, net ........................................ $324,528 375,999

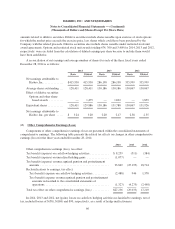

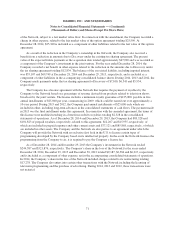

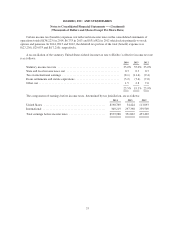

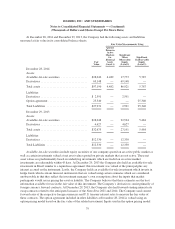

Intangible assets, other than those with indefinite lives, are reviewed for indications of impairment

whenever events or changes in circumstances indicate the carrying value may not be recoverable. During 2013,

the Company incurred $19,736 in impairment charges related to certain product lines which the Company exited

as well as product lines with reduced expectations. The Company will continue to incur amortization expense

related to the use of acquired and licensed rights to produce various products. A portion of the amortization of

these product rights will fluctuate depending on brand activation, related revenues during an annual period and

future expectations, as well as rights reaching the end of their useful lives. The Company currently estimates

amortization expense related to the above intangible assets for the next five years to be approximately:

2015 ..................................................................... $44,000

2016 ..................................................................... 35,000

2017 ..................................................................... 33,000

2018 ..................................................................... 24,000

2019 ..................................................................... 40,000

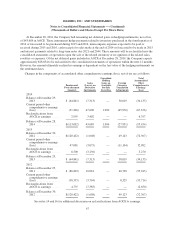

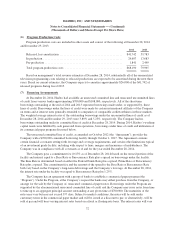

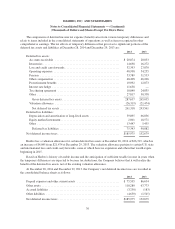

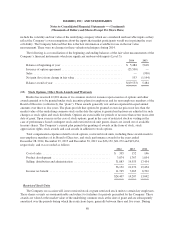

(5) Equity Method Investment

The Company owns an interest in a joint venture, Hub Television Networks, LLC (the “Network”), with

Discovery Communications, Inc. (“Discovery”). The Company has determined that it does not meet the control

requirements to consolidate the Network and accounts for the investment using the equity method of accounting.

The Network was established to create a cable television network in the United States dedicated to high-quality

children’s and family entertainment. In October 2009, the Company purchased an initial 50% share in the

Network for a payment of $300,000 and certain future tax payments based on the value of certain tax benefits

expected to be received by the Company. On September 23, 2014, the Company and Discovery amended their

relationship with respect to the Network and Discovery has increased its equity interest in the Network to 60%

while the Company retains a 40% equity interest in the Network. The change in equity interests was

accomplished partly through a redemption of interests owned by the Company and partly through the purchase of

interests by Discovery from the Company. In connection with this reduction in its equity ownership the Company

was paid a cash purchase price of $64,400 by Discovery. In connection with the restructuring of the Network, the

Company recognized a net expense of $28,326, which includes a charge resulting from an option agreement and

the Company’s share of severance charges and programming write-downs recognized by the Network, partially

offset by a gain from the reduction of amounts due to Discovery under a tax sharing agreement and is primarily

included in other (income) expense, net in the consolidated statements of operations.

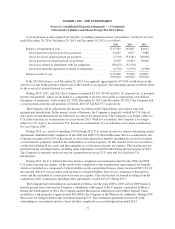

In connection with amendments, the Company and Discovery also entered into an option agreement related

to the Company’s remaining 40% ownership in the Network, exercisable during the one-year period following

December 31, 2021. The exercise price of the option agreement is based upon 80% of the then fair market value

70