Hasbro 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

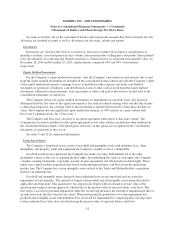

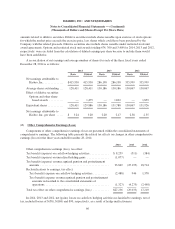

Accounts receivable, net on the consolidated balance sheet represents amounts due from customers less the

allowance for doubtful accounts as well as allowances for discounts, rebates and returns.

Inventories

Inventories are valued at the lower of cost (first-in, first-out) or market. Based upon a consideration of

quantities on hand, actual and projected sales volume, anticipated product selling price and product lines planned

to be discontinued, slow-moving and obsolete inventory is written down to its estimated net realizable value. At

December 28, 2014 and December 29, 2013, finished goods comprised 94% and 90% of inventories,

respectively.

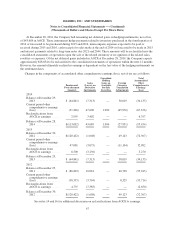

Equity Method Investment

For the Company’s equity method investments, only the Company’s investment in and amounts due to and

from the equity method investment are included in the consolidated balance sheets and only the Company’s share

of the equity method investment’s earnings (losses) is included in other expense, net in the consolidated

statements of operations. Dividends, cash distributions, loans or other cash received from the equity method

investment, additional cash investments, loan repayments or other cash paid to the investee are included in the

consolidated statements of cash flows.

The Company reviews its equity method investments for impairment on a periodic basis. If it has been

determined that the fair value of the equity investment is less than its related carrying value and that this decline

is other-than-temporary, the carrying value of the investment is adjusted downward to reflect these declines in

value. The Company has one significant equity method investment, its 40% interest in a joint venture with

Discovery Communications, Inc (“Discovery”).

The Company and Discovery are party to an option agreement with respect to this joint venture. The

Company has recorded a liability for this option agreement at fair value which is included in other liabilities in

the consolidated balance sheets. Unrealized gains and losses on this option are recognized in the consolidated

statements of operations as they occur.

See notes 5 and 12 for additional information.

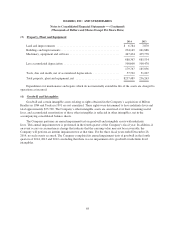

Long-Lived Assets

The Company’s long-lived assets consist of goodwill and intangible assets with indefinite lives, other

intangibles, and property, plant and equipment the Company considers to have a defined life.

Goodwill results from acquisitions the Company has made over time. Substantially all of the other

intangibles consist of the cost of acquired product rights. In establishing the value of such rights, the Company

considers existing trademarks, copyrights, patents, license agreements and other product-related rights. These

rights were valued on their acquisition date based on the anticipated future cash flows from the underlying

product line. The Company has certain intangible assets related to the Tonka and Milton Bradley acquisitions

that have an indefinite life.

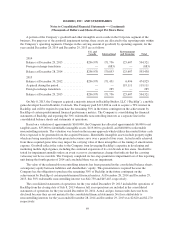

Goodwill and intangible assets deemed to have indefinite lives are not amortized and are tested for

impairment at least annually. The annual test begins with goodwill and all intangible assets being allocated to

applicable reporting units. This quantitative two-step process begins with an estimation of fair value of the

reporting unit using an income approach, which looks to the present value of expected future cash flows. The

first step is a screen for potential impairment while the second step measures the amount of impairment if there is

an indication from the first step that one exists. When performing the quantitative two-step impairment test,

goodwill and intangible assets with indefinite lives are tested for impairment by comparing their carrying value

to their estimated fair value, also calculated using the present value of expected future cash flows.

61