Hasbro 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and, as of October 13, 2014, now the Discovery Family Channel (the “Network”). Internationally, Hasbro

Studios also distributes to various broadcasters and cable networks and globally on various digital platforms,

including Netflix and iTunes. Beginning in 2015, Hasbro Studios will begin distributing certain programming

domestically to other outlets, including Cartoon Network. The Company’s television initiatives support its

strategy of growing its brands well beyond traditional toys and games and providing entertainment experiences

for consumers of all ages in many forms or formats.

The Network is the Company’s joint venture with Discovery Communications, Inc. (“Discovery”) and is a

cable television network in the United States dedicated to high-quality children’s and family entertainment and

educational programming. Programming on the Network includes content based on Hasbro’s brands as well as

programming developed by Discovery and other third parties. Prior to September 2014, the Company and

Discovery each owned a 50% equity interest in the Network. In September 2014, Hasbro and Discovery amended

their relationship with respect to the Network, reducing Hasbro’s equity interest from 50% to 40%.

Hasbro’s strategic blueprint and brand architecture focuses on extending its brands through digital media

and gaming. In support of this strategy, in 2013, the Company acquired a 70% majority ownership in Backflip

Studios, LLC (“Backflip”), a mobile game developer based in Boulder, Colorado. Backflip’s product offerings

include games for tablets and mobile devices including DRAGONVALE, NINJUMP and PAPER TOSS. New

game brands released during 2014 include DWARVEN DEN, PLUNDERNAUTS, SPELLFALL and

SEABEARD. Backflip also introduced two game brands under Hasbro brands, specifically NERFHOOPS and

TWISTER TAP. In 2015 and beyond, Backflip intends to continue focusing on its existing game titles,

particularly DRAGONVALE, and to launch new games, including those based on Hasbro brands. To further

extend its brands into digital media and gaming, the Company also out-licenses its properties to a number of

partners who develop and offer digital games and other gaming experiences based on those brands. One example

of these digital gaming relationships is the Company’s agreement with Electronic Arts Inc. (“EA”) under which

EA has the rights to develop several of Hasbro’s best-selling gaming brands for mobile platforms globally.

Similarly, the Company has an agreement with Activision under which Activision offers digital games based on

the TRANSFORMERS brand, as well as with other third-party digital gaming companies, including DeNA and

GameLoft.

Lastly, Hasbro seeks to express its brands through its lifestyle licensing business. Under its lifestyle

licensing programs, the Company enters into relationships with a broad spectrum of apparel, publishing, food,

bedding and other lifestyle products companies for the global marketing and distribution of licensed products

based on the Company’s brands. These relationships further broaden and amplify the consumer’s ability to

experience the Company’s brands.

As Hasbro seeks to grow its business in entertainment, licensing and digital gaming, the Company will

continue to evaluate strategic alliances, acquisitions and investments like Hasbro Studios and Backflip, which

may complement its current product offerings, allow it entry into an area which is adjacent to or complementary

to the toy and game business, or allow it to further develop awareness of its brands and expand the ability of

consumers to experience its brands in different forms and formats.

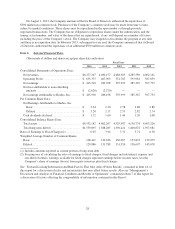

During the fourth quarter of 2012 the Company announced a multi-year cost savings initiative in which it

targets annual cost reductions of $100,000 by the end of 2015. This plan included an approximate 10% workforce

reduction, facility consolidations and process improvements which reduce redundancy and increase efficiencies.

From 2012 through 2014, the Company incurred aggregate restructuring and related pension charges of $84,972

and product-related charges of $19,736 related to this plan. Through 2014, the Company recognized gross cost

savings, before restructuring costs, from these actions of approximately $90,000. These savings are prior to other

costs which have or are anticipated to increase in 2014 and in future years, such as compensation costs and other

investments in certain components of the business.

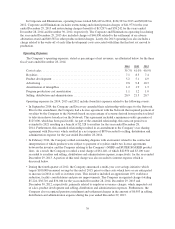

The Company’s business is highly seasonal with a significant amount of revenues occurring in the second

half of the year. In each of 2014 and 2013, the second half of the year accounted for 65% of net revenues while

the second half of 2012 accounted for 64% of net revenues.

31