Hasbro 2014 Annual Report Download - page 49

Download and view the complete annual report

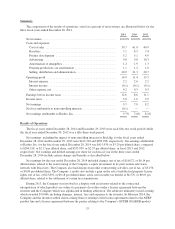

Please find page 49 of the 2014 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Net revenues from TRANSFORMERS products benefited from higher sales and license revenues related to

products based on the 2014 major motion picture release of TRANSFORMERS: AGE OF EXTINCTION, as well

as animated television programming in 2014, 2013 and 2012. Furthermore, net revenues from NERF products

also grew in both 2014 and 2013. Growth in these boys’ brands reflects Hasbro’s franchise brand-focused

strategy.

Sales of MARVEL products, primarily SPIDER-MAN and AVENGERS products, increased in 2014

compared to 2013. SPIDER-MAN was supported by the 2014 major motion picture release of THE AMAZING

SPIDER-MAN 2. 2014 net revenues also included sales related to the 2014 theatrical releases of CAPTAIN

AMERICA: THE WINTER SOLIDIER and GUARDIANS OF THE GALAXY. During 2013, sales of MARVEL

products were primarily related to IRON MAN, supported by the 2013 major motion picture release of IRON

MAN 3 and were lower than 2012, which included sales of AVENGERS and SPIDER-MAN related to the 2012

major motion picture releases of MARVEL’S THE AVENGERS and THE AMAZING SPIDER-MAN.

GAMES: Net revenues in the games category decreased 4% in 2014 compared to 2013 and increased 10% in

2013 compared to 2012. Net revenues in both 2014 and 2013 include the acquisition of Backflip. Franchise

brands MAGIC: THE GATHERING and MONOPOLY continued to grow in 2014 and 2013. In 2014, higher net

revenues from other games brands including SIMON, specifically SIMON SWIPE, THE GAME OF LIFE,

TROUBLE and DUNGEONS & DRAGONS were more than offset by lower net revenues from other games

brands, primarily DUEL MASTERS, ANGRY BIRDS and TWISTER. In 2013, several brands contributed to

games category growth including, but not limited to, MAGIC: THE GATHERING, JENGA, including sales of

products co-branded under ANGRY BIRDS, ELEFUN & FRIENDS, MONOPOLY, DUEL MASTERS, and

TWISTER, including TWISTER RAVE. These higher net revenues were partially offset by lower net revenues

from other game brands, including BATTLESHIP and SCRABBLE.

GIRLS: Net revenues in the girls’ category increased 2% in 2014 compared to 2013 and 26% in 2013

compared to 2012, primarily related to higher net revenues from franchise brands, MY LITTLE PONY and

NERF REBELLE in 2014 and 2013. Net revenues related to FURBY also contributed to higher net revenues in

2013 compared to 2012, however, declined in 2014 compared to 2013. Lower net revenues from LITTLEST PET

SHOP and FURREAL FRIENDS, partially offset growth in the girls’ category.

Net revenues from MY LITTLE PONY products experienced continued momentum with support from the

successful television program, MY LITTLE PONY: FRIENDSHIP IS MAGIC, as well as the third quarter 2013

introduction of MY LITTLE PONY EQUESTRIA GIRLS fashion doll products which were supported by

animated movie releases in both 2013 and 2014. NERF REBELLE, a line of action performance products,

introduced during the second half of 2013 also contributed to growth in 2014 and 2013. 2014 net revenues also

included the second quarter 2014 introduction of DOHVINCI, a line of arts and crafts products which leverages

the franchise brand PLAY-DOH.

Net revenues from FURBY declined in 2014 compared to 2013, which was expected based on the level of

net revenues achieved in 2013. 2013 was the first full year of net revenues from FURBY products including the

introduction of FURBY in non-English speaking markets. Revenues from FURBY, a fashion-oriented brand, are

generally higher in the first full year of introduction.

PRESCHOOL: Net revenues in the preschool category decreased 4% in 2014 compared to 2013 and

increased 1% in 2013 compared to 2012. In 2014, higher net revenues from franchise brands, PLAY-DOH and

TRANSFORMERS, particularly PLAYSKOOL HEROES TRANSFORMERS RESCUE BOTS which are

supported by animated television programming, were more than offset by lower net revenues from SESAME

STREET, core PLAYSKOOL and TONKA products. In 2013, higher net revenues from PLAY-DOH,

PLAYSKOOL HEROES, specifically TRANSFORMERS RESCUE BOTS, and SESAME STREET, including

BIG HUGS ELMO, products compared to 2012 were almost wholly offset by lower net revenues from TONKA

and core PLAYSKOOL products. In 2013, the Company out-licensed the distribution of TONKA products to a

third-party, thereby earning licensing revenue in 2014 and 2013 compared to wholesale revenue in 2012.

35