Hasbro 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

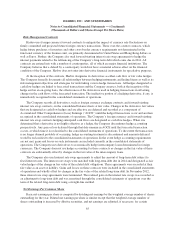

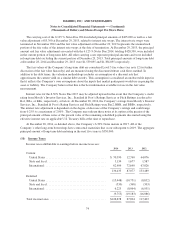

assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Deferred

taxes are measured using rates expected to apply to taxable income in years in which those temporary differences

are expected to reverse. A valuation allowance is provided for deferred tax assets if it is more likely than not such

assets will be unrealized. Deferred income taxes have not been provided on the majority of undistributed

earnings of international subsidiaries as the majority of such earnings are indefinitely reinvested by the

Company.

The Company uses a two-step process for the measurement of uncertain tax positions that have been taken

or are expected to be taken in a tax return. The first step is a determination of whether the tax position should be

recognized in the consolidated financial statements. The second step determines the measurement of the tax

position. The Company records potential interest and penalties on uncertain tax positions as a component of

income tax expense.

Foreign Currency Translation

Foreign currency assets and liabilities are translated into U.S. dollars at period-end exchange rates, and

revenues, costs and expenses are translated at weighted average exchange rates during each reporting period. Net

earnings include gains or losses resulting from foreign currency transactions and, when required, translation

gains and losses resulting from the use of the U.S. dollar as the functional currency in highly inflationary

economies. Other gains and losses resulting from translation of financial statements are a component of other

comprehensive earnings (loss).

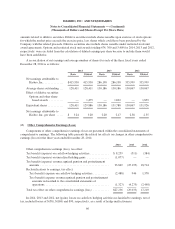

Pension Plans, Postretirement and Postemployment Benefits

Pension expense and related amounts in the consolidated balance sheet are based on actuarial computations

of current and future benefits. Actual results that differ from the actuarial assumptions are accumulated and, if

outside a certain corridor, amortized over future periods and, therefore affect recognized expense in future

periods. The Company’s policy is to fund amounts which are required by applicable regulations and which are

tax deductible. In 2015, the Company expects to contribute approximately $4,000 to its pension plans. The

estimated amounts of future payments to be made under other retirement programs are being accrued currently

over the period of active employment and are also included in pension expense. Hasbro has a contributory

postretirement health and life insurance plan covering substantially all employees who retire under any of its

United States defined benefit pension plans and meet certain age and length of service requirements. The cost of

providing these benefits on behalf of employees who retired prior to 1993 is and will continue to be substantially

borne by the Company. The cost of providing benefits on behalf of substantially all employees who retire after

1992 is borne by the employee. It also has several plans covering certain groups of employees, which may

provide benefits to such employees following their period of employment but prior to their retirement. The

Company measures the costs of these obligations based on actuarial computations.

Stock-Based Compensation

The Company has a stock-based employee compensation plan for employees and non-employee members of

the Company’s Board of Directors. Under this plan the Company may grant stock options at or above the fair

market value of the Company’s stock, as well as restricted stock, restricted stock units and contingent stock

performance awards. All awards are measured at fair value at the date of the grant and amortized as expense on a

straight-line basis over the requisite service period of the award. For awards contingent upon Company

performance, the measurement of the expense for these awards is based on the Company’s current estimate of its

performance over the performance period. For awards contingent upon the achievement of market conditions, the

probability of satisfying the market condition is considered in the estimation of the grant date fair value. See note

13 for further discussion.

64