Hasbro 2014 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2014 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

enabled this performance and our ongoing focus

toward lowering costs and maximizing profitability is

delivering results.

We ended the year in a strong financial position,

generating $454 million in operating cash flow

during the year and with $893 million of cash on

the balance sheet. After investing back into our

business, which remains our top priority, our financial

strength enabled us to return $678 million to you,

our shareholders, through our dividend and share

repurchase program. In early 2015, based on the

strength of our business the Board increased the

quarterly dividend 7% to $0.46 per share, and

authorized an additional $500 million for share

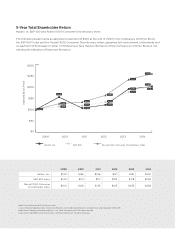

repurchases. Through our commitment to returning

excess cash to shareholders, we have returned

143% of net earnings through dividends and share

repurchases over the past five years.

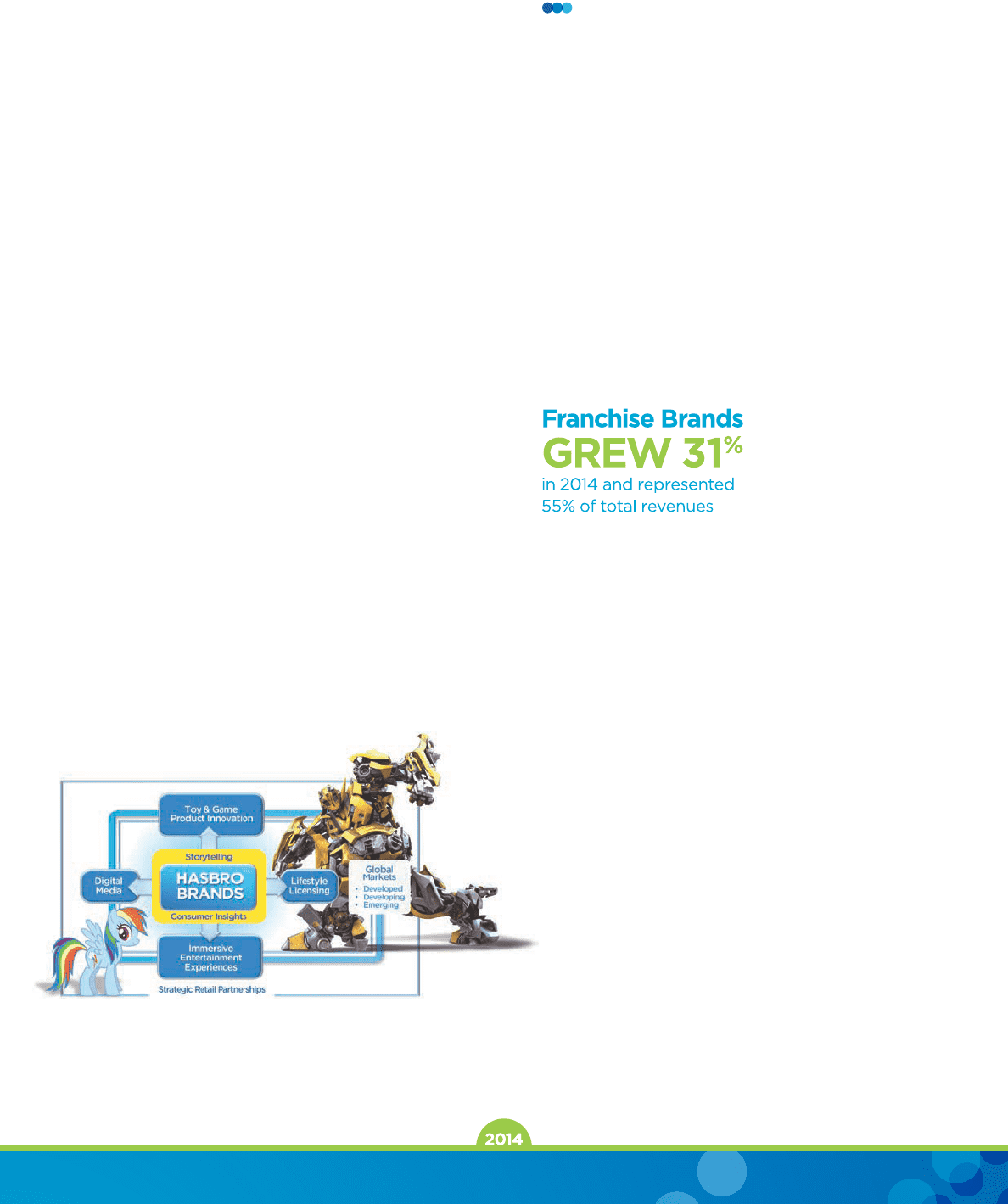

As we have outlined for you in previous years,

everything we do at Hasbro begins with our Brand

Blueprint. Our execution of the blueprint drove these

strong 2014 results and provides the framework for

our actions going forward. The blueprint informs and

guides our investments, our decision-making and

our behaviors. Consumer insights and storytelling

surround our brands and sit at the center of our

Brand Blueprint. It serves not only as a strategic

roadmap, but is also a key element that dierentiates

Hasbro in a competitive global marketplace.

Our Brands Are the Organizing Principle

Today, brands are serving as the organizing

principle for consumers around the world. To

maximize the long-term returns for Hasbro

shareholders, we focus on driving the development

of bigger, more global brands, which hold the

greatest revenue and profit potential. These are our

Franchise Brands: LITTLEST PET SHOP, MAGIC: THE

GATHERING, MONOPOLY, MY LITTLE PONY, NERF,

PLAY-DOH and TRANSFORMERS. Six of these seven

brands grew in 2014. LITTLEST PET SHOP, the one

brand which did not grow, was relaunched in the

second half of the year and is o to a good start in

many markets.

As a result of our increased investment in and

focus on these brands, Franchise Brand revenues

grew 31% and

represented 55% of

total 2014 Hasbro

revenues. This growth

was driven by story-

led brands including

MY LITTLE PONY

and TRANSFORMERS, but also from innovation

based firmly in our global consumer insights for

brands including NERF and PLAY-DOH. Several

Franchise Brands posted their highest-ever annual

revenues—MAGIC: THE GATHERING, MY LITTLE

PONY, NERF and PLAY-DOH. The theatrical release

of TRANSFORMERS: AGE OF EXTINCTION, 2014’s

highest-grossing film at the global box oce, drove

strong growth in TRANSFORMERS revenues for the

year.

Given their global potential, our Franchise Brands

remain a top priority for our teams. We are also

cultivating many additional and potentially significant

Hasbro brands, including PLAYSKOOL, FURREAL

FRIENDS, BABY ALIVE and many of our games

brands. At the same time, we are developing new

brands and innovations within our portfolio.

In addition to our eorts to build Hasbro’s own

brands, select premium partner brands complete our

portfolio across consumer groups and geographies.

In 2014, great storytelling and content, supported by

ANNUAL REPORT