Hasbro 2014 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2014 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

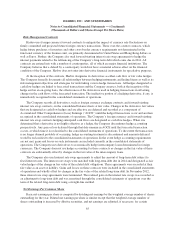

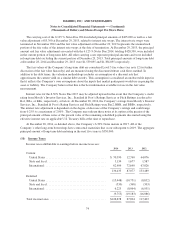

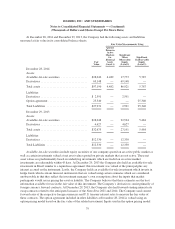

Certain income tax (benefits) expenses, not reflected in income taxes in the consolidated statements of

operations totaled $(38,223) in 2014, $6,733 in 2013 and $(31,682) in 2012 which relate primarily to stock

options and pensions. In 2014, 2013 and 2012, the deferred tax portion of the total (benefit) expense was

$(27,236), $29,033 and $(17,210), respectively.

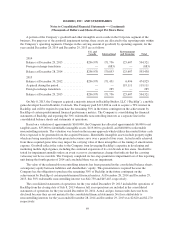

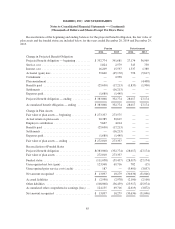

A reconciliation of the statutory United States federal income tax rate to Hasbro’s effective income tax rate

is as follows:

2014 2013 2012

Statutory income tax rate .......................................... 35.0% 35.0% 35.0%

State and local income taxes, net .................................... 0.3 0.3 0.3

Tax on international earnings ....................................... (8.1) (11.4) (9.4)

Exam settlements and statute expirations .............................. (5.2) (7.4) (7.0)

Other, net ....................................................... 1.5 2.8 7.0

23.5% 19.3% 25.9%

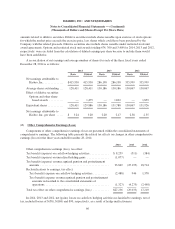

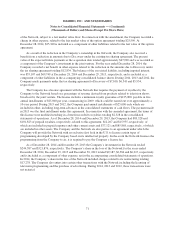

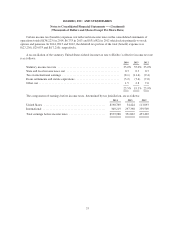

The components of earnings before income taxes, determined by tax jurisdiction, are as follows:

2014 2013 2012

United States .......................................... $190,769 54,424 113,893

International ........................................... 349,219 297,398 339,509

Total earnings before income taxes ......................... $539,988 351,822 453,402

75