Hasbro 2014 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2014 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

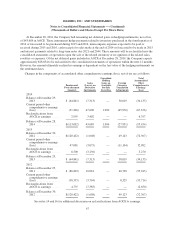

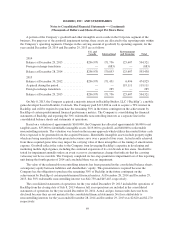

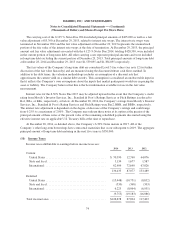

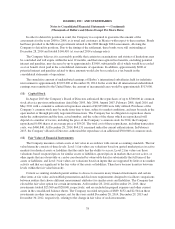

A portion of the Company’s goodwill and other intangible assets reside in the Corporate segment of the

business. For purposes of the goodwill impairment testing, these assets are allocated to the reporting units within

the Company’s operating segments. Changes in the carrying amount of goodwill, by operating segment, for the

years ended December 28, 2014 and December 29, 2013 are as follows:

U.S. and

Canada International

Entertainment

and Licensing Total

2014

Balance at December 29, 2013 ............. $296,978 171,736 125,607 594,321

Foreign exchange translation .............. — (883) — (883)

Balance at December 28, 2014 ............. $296,978 170,853 125,607 593,438

2013

Balance at December 30, 2012 ............. $296,978 171,451 6,496 474,925

Acquired during the period ................ — — 119,111 119,111

Foreign exchange translation .............. — 285 — 285

Balance at December 29, 2013 ............. $296,978 171,736 125,607 594,321

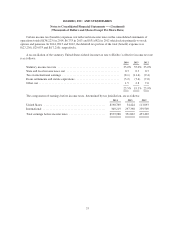

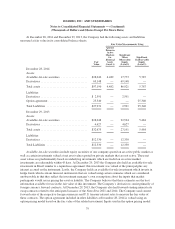

On July 8, 2013, the Company acquired a majority interest in Backflip Studios, LLC (“Backflip”), a mobile

game developer based in Boulder, Colorado. The Company paid $112,000 in cash to acquire a 70% interest in

Backflip, and will be required to purchase the remaining 30% in the future contingent on the achievement by

Backflip of certain predetermined financial performance metrics. The Company is consolidating the financial

statements of Backflip and reporting the 30% redeemable noncontrolling interests as a separate line in the

consolidated balance sheets and statements of operations.

Based on a valuation of approximately $160,000, the Company has allocated approximately $6,000 to net

tangible assets, $35,000 to identifiable intangible assets, $119,000 to goodwill, and $48,000 to redeemable

noncontrolling interests. The valuation was based on the income approach which utilizes discounted future cash

flows expected to be generated from the acquired business. Identifiable intangible assets include property rights

which are being amortized over the projected revenue curve over a period of four years. Actual results achieved

from these acquired game titles may impact the carrying value of these intangibles or the timing of amortization

expense. Goodwill reflects the value to the Company from leveraging Backflip’s expertise in developing and

marketing mobile digital games, including the continued expansion of its own brands in this arena. Goodwill is

tested for impairment annually unless an event occurs or circumstances change that indicate that the carrying

value may not be recoverable. The Company completed its two-step quantitative impairment test of this reporting

unit during the fourth quarter of 2014 and concluded there was no impairment.

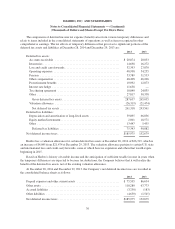

The value of the redeemable noncontrolling interests has been presented in the consolidated balance sheets

as temporary equity between liabilities and shareholders’ equity. This presentation is required because the

Company has the obligation to purchase the remaining 30% of Backflip in the future contingent on the

achievement by Backflip of certain predetermined financial metrics. At December 28, 2014 and December 29,

2013, this 30% redeemable noncontrolling interest was $42,730 and $45,445, respectively.

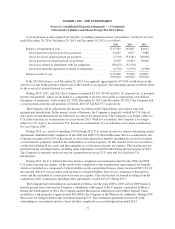

The consolidated statements of operations for the year ended December 29, 2013 included the operations of

Backflip from the closing date of July 8, 2013 whereas full year operations are included in the consolidated

statements of operations for the year ended December 28, 2014. Actual and pro forma results have not been

disclosed because they are not material to the consolidated financial statements. Net loss attributable to

noncontrolling interests for the years ended December 28, 2014 and December 29, 2013 was $2,620 and $2,270

respectively.

69