Haier 2006 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2006 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149

|

|

95

Haier Electronics Group Co., Ltd. Annual Report 2006

海爾電器集團有限公司 二零零六年年報

Notes to Financial Statements

財務報表附註 (31 December 2006)

(二零零六年十二月三十一日)

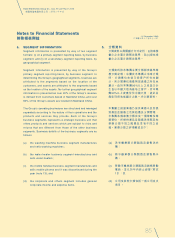

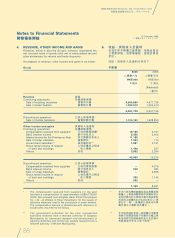

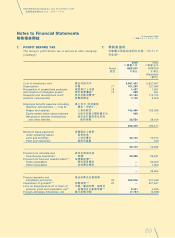

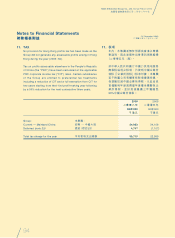

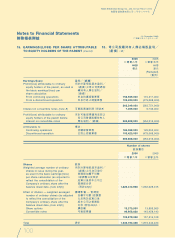

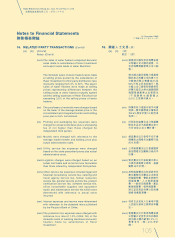

11. TAX

(Cont’d)

A reconciliation of the tax charge applicable to profit/loss

before tax using the statutory or applicable rates for the

jurisdictions in which the Company and its subsidiaries are

domiciled to the tax charge at the effective tax rates, and a

reconciliation of the statutory or applicable rates to the

effective tax rates, are as follows:

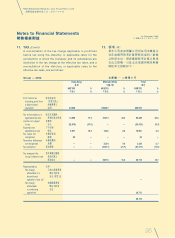

Group — 2006

Hong Kong Mainland China Total

香港 中國大陸 總計

HK$’000 % HK$’000 % HK$’000 %

千港元 %千港元 %千港元 %

Profit before tax 除稅前溢利

(including profit from (包括已終止

a discontinued 經營業務之

operation) 溢利) 62,029 264,887 326,916

Tax at the statutory or 按法定或適用

applicable tax rate 稅率計算之稅項 10,855 17.5 87,413 33.0 98,268 30.0

Income not subject 非課稅

to tax 收入 (20,478 ) (33.0 ) ——(20,478 ) (6.3 )

Expenses not 不可扣稅

deductible for tax 開支 9,571 15.5 7,330 2.8 16,901 5.2

Tax losses not 未確認稅項

recognised 虧損 52 ———52 —

Temporary differences 未確認暫時

not recognised 差額 — — 2,384 0.9 2,384 0.7

Tax exemption 稅項豁免 ——(57,417 ) (21.7 ) (57,417 ) (17.5 )

Tax charge at the 按本集團之實際

Group’s effective rate 稅率計算之

稅項支出 ——39,710 15.0 39,710 12.1

Represented by: 代表:

Tax charge 已終止經營業務

attributable to a 應佔之稅項

discontinued 支出

(附註

13

)

operation

(note 13)

—

Tax charge 持續經營業務

attributable 應佔之稅項

to continuing 支出

operations 39,710

39,710

11. 稅項

(續)

按本公司及其附屬公司所在司法權區之

法定或適用稅率計算除稅前溢利虧損

之稅項支出,與按實際稅率計算之稅項

支出之對賬,以及法定或適用稅率與實

際稅率之對賬如下:

本集團 — 二零零六年