Haier 2006 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2006 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

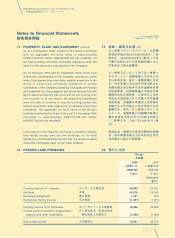

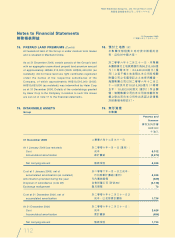

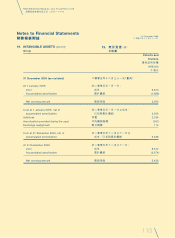

Notes to Financial Statements

財務報表附註 (31 December 2006)

(二零零六年十二月三十一日)

114

Haier Electronics Group Co., Ltd. Annual Report 2006

海爾電器集團有限公司 二零零六年年報

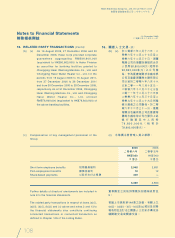

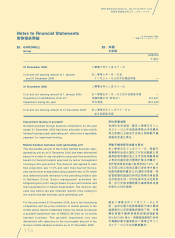

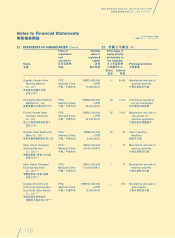

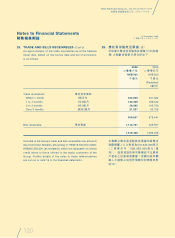

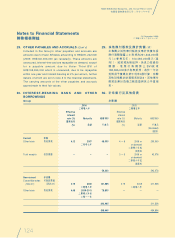

20. GOODWILL

Group

HK$’000

千港元

31 December 2006 二零零六年十二月三十一日

Cost and net carrying amount at 1 January 於二零零六年一月一日及

and 31 December 2006 十二月三十一日之成本及賬面淨值 —

31 December 2005 二零零五年十二月三十一日

Cost and net carrying amount at 1 January 2005 於二零零五年一月一日之成本及賬面淨值 —

Acquisition of subsidiaries

(note 37)

收購附屬公司

(附註

37

)

321,947

Impairment during the year 年內減值 (321,947)

Cost and net carrying amount at 31 December 2005 於二零零五年十二月三十一日之

成本及賬面淨值 —

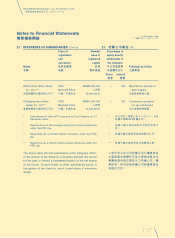

Impairment testing of goodwill

Goodwill acquired through business combination for the year

ended 31 December 2005 had been allocated to the mobile

handset business cash-generating unit, which was a reportable

segment, for impairment testing.

Mobile handset business cash-generating unit

The recoverable amount of the mobile handset business cash-

generating unit as at 31 December 2005 had been determined

based on a value in use calculation using cash flow projections

based on financial budgets approved by senior management

covering a five-year period. The discount rate applied to cash

flow projections was 17.2% and cash flows beyond the five-

year period were extrapolated using a growth rate of 3% which

was determined with reference to the prevailing inflation rate

in Mainland China. Senior management estimated the

budgeted gross profit margin based on past performance and

their expectations for market development. The discount rate

used was before tax and reflected specific risks relating to

the mobile handset business cash-generating unit.

For the year ended 31 December 2005, due to the intensifying

competition and the price reduction of mobile phones in the

mobile phone market in Mainland China, the Group recognised

a goodwill impairment loss of HK$321,947,000 for its mobile

handset business. The goodwill impairment loss was

determined with reference to the recoverable amount of the

Group’s mobile handset business as at 31 December 2005.

20. 商譽

本集團

評估商譽減值

為評估有否減值,截至二零零五年十二

月三十一日止年度透過業務合併收購所

得之商譽已分配至可呈報分類移動手機

業務現金產生單位。

移動手機業務現金產生單位

於二零零五年十二月三十一日,移動手

機業務現金產生單位之可收回數額已根

據高級管理層批准之五年財政預算預測

之現金流量按使用價值計算法而釐定。

用作預測現金流量之貼現率為17.2%,而

五年期以後之現金流量乃按參考中國大

陸當時通賬率釐定之3%增長率推算。高

級管理層根據過往表現及預期市場發展

估計預測毛利。所用貼現率並未扣除稅

項,及已反映有關移動手機業務現金產

生單位之特定風險。

截至二零零五年十二月三十一日止年

度,由於中國大陸移動電話市場之競爭

越趨激烈以及移動電話價格下跌,本集

團就移動手機業務確認商譽減值虧損

321,947,000 港元。商譽減值虧損乃參考

本集團移動手機業務於二零零五年十二

月三十一日之可收回數額釐定。