Haier 2006 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2006 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149

|

|

143

Haier Electronics Group Co., Ltd. Annual Report 2006

海爾電器集團有限公司 二零零六年年報

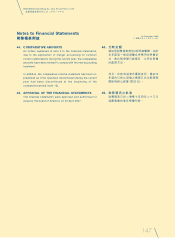

Notes to Financial Statements

財務報表附註 (31 December 2006)

(二零零六年十二月三十一日)

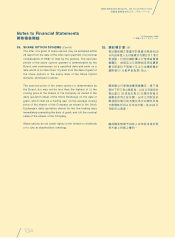

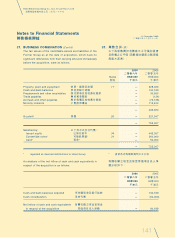

38. DISPOSAL OF SUBSIDIARIES

(Cont’d)

An analysis of the net outflow of cash and cash equivalents

in respect of the disposal of subsidiaries is as follows:

2006 2005

二零零六年 二零零五年

HK$’000 HK$’000

千港元 千港元

Cash consideration 現金代價 ——

Cash and cash equivalents disposed of 所出售現金及現金等值項目 (38,534) —

Net outflow of cash and cash equivalents 有關出售附屬公司之現金及

in respect of the disposal of subsidiaries 現金等值項目流出淨額 (38,534) —

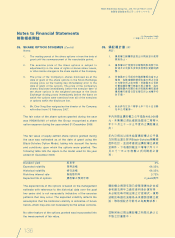

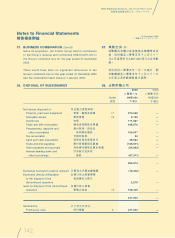

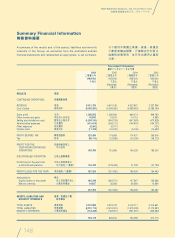

39. CONTINGENT LIABILITIES

At the balance sheet date, neither the Group nor the Company

had any significant contingent liabilities.

40. OPERATING LEASE ARRANGEMENTS

(a) As lessor

At 31 December 2006, the Group did not have any future

minimum lease receivables.

For the year ended 31 December 2005, the Group leased

part of its buildings under an operating lease

arrangement, with the lease negotiated for a term of

one year. At 31 December 2005, the Group had total

future minimum lease receivables of HK$1,356,000 under

a non-cancellable operating lease with its tenants falling

due within one year.

38. 出售附屬公司

(續)

有關出售附屬公司之現金及現金等值項

目流出淨額分析如下:

39. 或然負債

於結算日,本集團及本公司均無任何重

大或然負債。

40. 經營租約安排

(a) 作為出租人

於二零零六年十二月三十一日,本

集團並無任何未來最低租約應收賬

款。

截至二零零五年十二月三十一日止

年度,本集團根據經營租約安排出

租其部分樓宇,議定之租期為一

年。於二零零五年十二月三十一

日,本集團根據與其租戶於一年內

到期之不能取消之經營租約有未來

最低租約應收賬款總額為1,356,000

港元。