Haier 2006 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2006 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements

財務報表附註 (31 December 2006)

(二零零六年十二月三十一日)

140

Haier Electronics Group Co., Ltd. Annual Report 2006

海爾電器集團有限公司 二零零六年年報

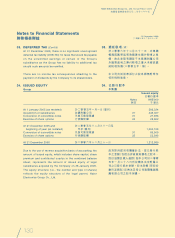

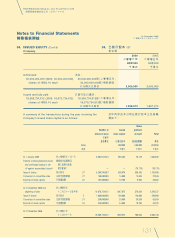

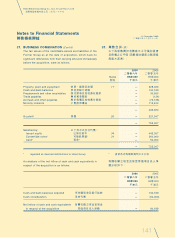

37. BUSINESS COMBINATION

On 28 January 2005, the Company acquired from Haier Group

its entire 100% interest in Haier Holdings (BVI) Limited and

Qingdao Haier Investment and Development Holdings (BVI)

Limited, for an aggregate consideration of RMB1,100 million

(equivalent to approximately HK$1,035 million) (the “Asset

Injection”). The total consideration of HK$1,035 million was

satisfied as to HK$725 million by the issuance of 4,027 million

ordinary shares of the Company at HK$0.18 each, HK$260

million by the issuance of convertible notes of the Company

and HK$50 million in cash.

On the same date, the Company exercised its call option to

acquire from Haier Investment its entire 35.5% interest in

Pegasus Qingdao for a consideration of HK$468.6 million (the

“Call Option Exercise”). The consideration was satisfied by

the issuance of 2,343 million ordinary shares of the Company

at HK$0.20 each.

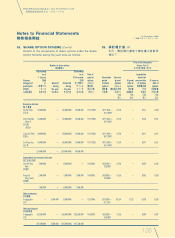

Upon completion of the Asset Injection and Call Option

Exercise, Haier Group’s interest in the Company collectively

increased to 50.2% and Haier Group became the controlling

shareholder of the Company.

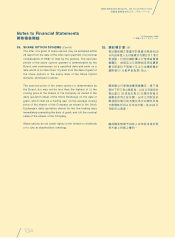

Under HKFRS 3

Business combinations

, the Asset Injection

and Call Option Exercise were accounted for as a reverse

acquisition since the issuance of the consideration shares

resulted in Haier Group becoming the controlling shareholder

of the Company. For accounting purpose, Haier Group’s

interest in Haier Holdings (BVI) Limited, Qingdao Haier

Investment and Development Holdings (BVI) Limited and

Pegasus Qingdao (collectively referred to as the “Haier

Businesses”) is treated as the acquirer while the Company

and its relevant interest in the then subsidiaries (collectively

referred to as the “Former Group”) is deemed to have been

acquired by the Haier Businesses on 28 January 2005.

37. 業務合併

於二零零五年一月二十八日,本公司向

海爾集團收購海爾控股(BVI)有限公司及

青島海爾投資發展有限公司全部100%權

益,總代價為人民幣1,100,000,000元(相

等於約1,035,000,000港元)(「注入資

產」)。總代價1,035,000,000港元中

725,000,000港元透過按每股0.18港元發

行4,027,000,000股本公司普通股之方式

支付、260,000,000港元透過發行本公司

可換股票據之方式支付及50,000,000港元

以現金支付。

同日,本公司行使其認購期權,以向海

爾投資收購其於飛馬青島之全部35.5%權

益,

代價為468,600,000港元(「行使認購

期權」)。代價透過按每股0.20港元發行

2,343,000,000股本公司普通股之方式支

付。

於完成注入資產及行使認購期權後,海

爾集團佔本公司之權益合共增加至

50.2%,而海爾集團成為本公司之控股股

東。

根據香港財務報告準則第3號

業務合併

,

由於發行代價股份導致海爾集團成為本

公司之控股股東,故注入資產及行使認

購期權將列作逆向收購入賬。就會計而

言,海爾集團所擁有的海爾控股(BVI)有

限公司、青島海爾投資發展有限公司及

飛馬青島權益(統稱為「海爾業務」)被視

為收購者,而本公司及其當時附屬公司

之相關權益(統稱為「前集團」)則視為由

海爾業務於二零零五年一月二十八日所

收購。