Haier 2006 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2006 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements

財務報表附註 (31 December 2006)

(二零零六年十二月三十一日)

136

Haier Electronics Group Co., Ltd. Annual Report 2006

海爾電器集團有限公司 二零零六年年報

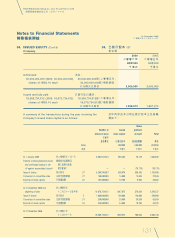

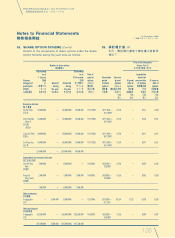

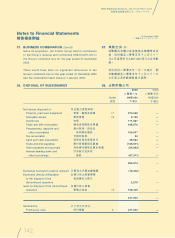

35. SHARE OPTION SCHEMES

(Cont’d)

Notes:

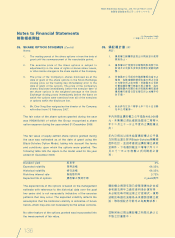

1. The vesting period of the share options is from the date of

grant until the commencement of the exercisable period.

2. The exercise price of the share options is subject to

adjustment(s) in the case of rights or bonus share issues,

or other similar changes in the share capital of the Company.

3. The price of the Company’s shares disclosed as at the

date of grant of the share options is the Stock Exchange

closing price on the trading day immediately prior to the

date of grant of the options. The price of the Company’s

shares disclosed immediately before the exercise date of

the share options is the weighted average of the Stock

Exchange closing prices immediately before the dates on

which the options were exercised over all of the exercises

of options within the disclosure line.

4. Mr. Chai Yong Sen resigned as the director of the Company

with effect from 15 February 2007.

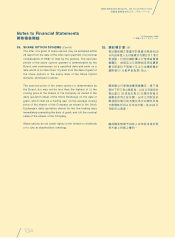

The fair value of the share options granted during the year

was HK$409,000 of which the Group recognised a share

option expense during the year ended 31 December 2006.

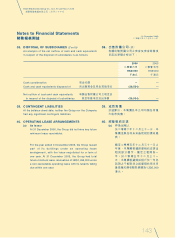

The fair value of equity-settled share options granted during

the year was estimated as at the date of grant using the

Black-Scholes Option Model, taking into account the terms

and conditions upon which the options were granted. The

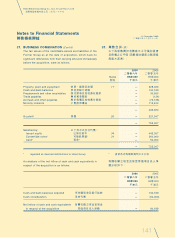

following table lists the inputs to the model used for the year

ended 31 December 2006:

Dividend yield 股息率 0%

Expected volatility 預期波幅 68.35%

Historical volatility 過往波幅 68.35%

Risk-free interest rate 無風險利率 3.73%

Expected life of options 購股權之預期年期 2 years兩年

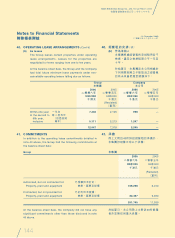

The expected life of the options is based on the management

estimate with reference to the historical data over the past

two years and is not necessarily indicative of the exercise

patterns that may occur. The expected volatility reflects the

assumption that the historical volatility is indicative of future

trends, which may also not necessarily be the actual outcome.

No other feature of the options granted was incorporated into

the measurement of fair value.

35. 購股權計劃

(續)

附註:

1. 購股權之歸屬期由授出日期起至行使期

開始為止。

2. 購股權之行使價可於配售新股或發行紅

股或本公司股本出現其他類似變動時調

整。

3. 所披露本公司股份於購股權授出當日之

價格,為緊接購股權授出當日前之交易

日在聯交所之收市價。所披露本公司股

份緊接購股權行使當日前之價格,為在

披露範圍內有關行使所有購股權在緊接

購股權行使當日前在聯交所之加權平均

收市價。

4. 柴永森先生於二零零七年二月十五日辭

任本公司董事。

年內所授出購股權之公平值為409,000港

元,本集團已將此確認為截至二零零六

年十二月三十一日止年度內之購股權支

出。

年內已授出以股本結算購股權之公平值

乃於授出當日採用Black-Scholes期權模

型作估計,並經考慮授出購股權之條款

及條件。下表載列截至二零零六年十二

月三十一日止年度輸入所用模型之資

料:

購股權之預期年期乃按管理層估計並經

參考過去兩年之過往資料後計算所得,

未必能反映可能出現之行使模式。預期

波幅反映過往波幅為未來趨勢指標之假

設,惟該假設亦可能未必為真實結果。

並無其他已授出購股權之特點已納入公

平值之計量當中。