Haier 2006 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2006 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

137

Haier Electronics Group Co., Ltd. Annual Report 2006

海爾電器集團有限公司 二零零六年年報

Notes to Financial Statements

財務報表附註 (31 December 2006)

(二零零六年十二月三十一日)

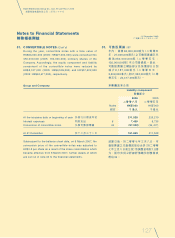

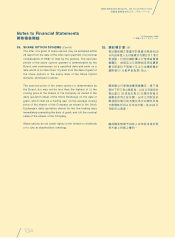

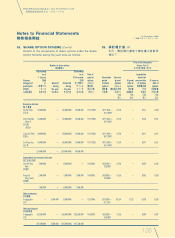

35. SHARE OPTION SCHEMES

(Cont’d)

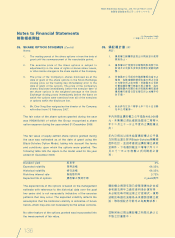

The 345,000,000 share options exercised during the year

resulted in the issue of 345,000,000 (2005:187,000,000)

ordinary shares of the Company and new share capital of

HK$34,500,000 (2005: HK$18,700,000) and share premium

of HK$18,792,000 (2005: HK$9,902,000) (before issue

expenses), as further detailed in note 34 to the financial

statements.

At the balance sheet date, the Company had 267,500,000

share options outstanding under the Share Option Scheme.

The exercise in full of the remaining share options would,

under the present capital structure of the Company, result in

the issue of 267,500,000 additional ordinary shares of the

Company (representing approximately 1.5% of the Company’s

shares in issue at the balance sheet date) and additional

share capital of HK$26,750,000 and share premium of

HK$14,740,000 (before issue expenses).

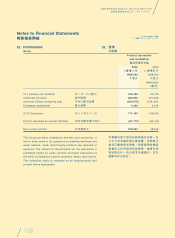

Subsequent to the balance sheet date, certain directors of

the Company exercised in aggregate of 40,000,000 share

options at HK$0.15 each and other participants of the Share

Option Scheme exercised in aggregate 62,500,000 share

options at HK$0.156 each.

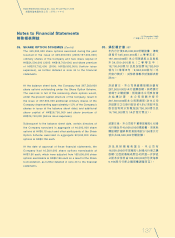

At the date of approval of these financial statements, the

Company had 16,500,000 share options exercisable at

HK$1.56 each, which were adjusted from 165,000,000 share

options exercisable at HK$0.156 each as a result of the Share

Consolidation, as further detailed in note 43 to the financial

statements.

35. 購股權計劃

(續)

年內已行使345,000,000份購股權,導致

須發行345,000,000股(二零零五年:

187,000,000股)本公司普通股以及新股

本34,500,000港元(二零零五年:

18,700,000港元)及股份溢價18,792,000

港元(二零零五年:9,902,000港元)(未

計發行開支),其他詳情載於財務報表附

註34。

於結算日,本公司根據購股權計劃有

267,500,000份未行使購股權。倘悉數行

使餘下之購股權,則根據本公司現有資

本結構計算,本公司須額外發行

267,500,000股本公司普通股(佔本公司

於結算日之已發行股份約1.5%)而股本及

股份溢利將分別增加26,750,000港元及

14,740,000港元(未計發行開支)。

結算日後,本公司若干董事按每股0.15港

元行使合共40,000,000份購股權,而其他

購股權計劃參與者則按每股0.156港元行

使合共62,500,000份購股權。

於批准財務報表當日,本公司有

16,500,000份可按每股1.56港元行使之購

股權(已因財務報表附註43所進一步詳述

之股本合併而由165,000,000份可按每股

0.156港元行使之購股權調整而至)。