Haier 2006 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2006 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

145

Haier Electronics Group Co., Ltd. Annual Report 2006

海爾電器集團有限公司 二零零六年年報

Notes to Financial Statements

財務報表附註 (31 December 2006)

(二零零六年十二月三十一日)

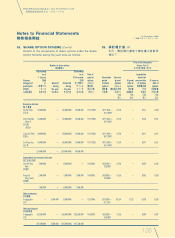

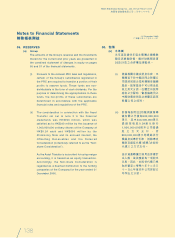

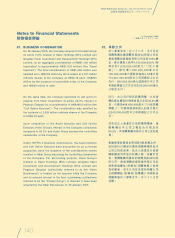

42. FINANCIAL RISK MANAGEMENT OBJECTIVES

AND POLICIES

The Group’s principal financial instruments comprise

convertible notes, other interest-bearing loans and cash and

short term deposits. The main purpose of these financial

instruments is to raise finance for the Group’s operations or

acquisitions. The Group has various other financial assets

and liabilities such as trade receivables and trade payables,

which arise directly from its operations.

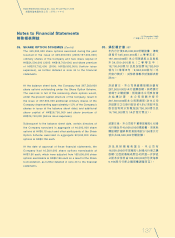

It is, and has been throughout the year under review, the

Group’s policy that no trading in financial instruments shall

be undertaken.

The main risks arising from the Group’s financial instruments

are cash flow interest rate risk, foreign currency risk, credit

risk and liquidity risk. The board reviews and agrees policies

for managing each of these risks and they are summarised

below.

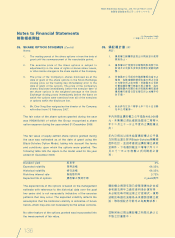

Cash flow interest rate risk

The Group’s exposure to the risk of changes in market interest

rates related primarily to the Group’s loans and borrowings

with floating interest rates. The Group’s policy is to manage

its interest cost using a mix of fixed and variable rate debts.

Foreign currency risk

The Group has transactional currency exposures. Such

exposures arise from sales or purchases by operating units

in currencies other than the units’ functional currency. The

Group’s foreign currency risk is not considered significant

because most of the Group’s sales and purchases are

denominated in RMB.

Credit risk

The Group trades only with recognised and creditworthy

customers. It is the Group’s policy that all customers who

wish to trade on credit terms are subject to credit verification

procedures. In addition, receivable balances are monitored

on an ongoing basis and the Group’s exposure to bad debts

is not significant.

42. 財務風險管理目標及政策

本集團之主要金融工具包括可換股票

據、其他計息貸款及現金與短期存款。

該等金融工具之主要目的是為本集團營

運或收購集資。本集團有多種其他財務

資產及負債,如直接來自業務之應收及

應付貿易賬款。

於整個回顧年度,本集團之政策為不進

行任何金融工具買賣。

來自本集團金融工具之主要風險為現金

流量利率風險、外幣風險、信貸風險及

流動資金風險。董事會檢討及協定各類

風險之監控政策概述如下。

現金流量利率風險

本集團之市場利率變動風險主要有關本

集團之浮息貸款及借貸承擔。本集團之

政策是借入固定及浮動利率之借貸組

合,以管理利息成本。

外幣風險

本集團涉及交易貨幣風險。該等風險來

自營運單位以功能貨幣以外貨幣進行銷

售或購買。由於本集團大部分銷售及採

購均以人民幣列值,故外幣風險並不重

大。

信貸風險

本集團僅與著名及信譽良好之客戶進行

交易。根據本集團之政策,任何有意以

記賬形式進行交易之客戶均須經過信貸

核實程序。此外,本集團亦持續監察應

收賬款結餘,而本集團之壞賬風險並不

重大。